Introduction

Management accounting within the business is needed to implement numerous accounting ways to work the operations correct manner. This report focuses on the analysis of management accounting ways that are applicable for the business operations. The report explains edges and disadvantages of the assorted designing ways applied for monetary fund management. Additionally to the present, the report conjointly recommend by which a company will create the employment of explained ways so monetary issues are often managed. During this manner, numerous ways of company accounting are explained that are are useful in coping with economic issues.

LO3

P4

The advantages and downsides of designing techniques used for monetary fund management is as follows-

Advantages

- Budgeting: The particular amount money to pay premiums within the same months to manage their financial gain they are gift to verify and to pay their bills frequently i.e., monthly they are prepared for these payments.

- Worth Setting: Market things like your enemies costs aren’t the alone limits they want to line their fees, costs and prices. They desires to inform their production and overhead prices before you set your rates (Cooper. et., al, 2017). A budget permits them to endeavor their service, health care, marketing, rent, wages, debt charges and various costs so they are going to be ready to learn existence worth per unit of constructing their product or delivering their service. Once you acknowledge this, they are going to be ready to set their prices to create the profit they might like.

- Capital and Credit procural: Few deals capitalists, banks, dealers or various house owners will offer them with money or trust unless they need got cash inquiry to gauge they are a going interest (Abdelmoneim & Jones, 2014).

Disadvantages

- The character of the account is numeric, so it tends to focus government attention on the quantitative ways of an employment. In reality, customers don’t care exercise the profits of a business.

- Blame for results: If the agency does not bring home the bacon its accounted results, the agency controller may action on the opposite agency that offers services to that for not having fully supported is agency (Turner & Guilding, 2012).

- Expense allotment: The budget may impose that positive amounts of overhead costs are assigned to varied departments, and so the controllers of those agencies may trouble the allotment ways in which used.

- Time needed: The time exercised is lesser if there is a well constructed accounting method in place, employees equal half awake to the strategy, and so the organization uses accounting package (Turner & Guilding, 2012).

M3

Planning tools

- Budgeting

When they have selected what their possible planning involves, they should prefer how these plans are to be sustained (Paulsson, 2012). Understanding of a monetary arrangement is a basic device in guaranteeing that they stay answerable for your operating cost

- Calculating assets

- Affirming that approved achievement can in reality be finance.

- Settling on capital related options in a knowledgeable and very much skilled way.

- Recognizing regions of possible problem and manufacture planning for same.

- Calculating implementation to date beside pre-arranged limit (Cooper. et., al, 2017).

The character of data given by a monetary plan is balanced to the effort that has been put reserves into it. A financial arrangement on the off possibility that it is to be flourishing should determine the agreement among calculating in somewhat slack to take into explanation unpredicted occasions, while in the interim individual regions in which operating cost can be cut.

- Cash Flow Forecasting

While arrangement is a helpful apparatus for organizing purposes, a Cash Flow Forecast is increasingly perceptive by its very character. It helps the capitalist in unique summits and channels in depository account. A revenue measure will assist with recognizing the requirement in which growth is to be supervises. The revenue estimate is characteristic in character and will help with casting feasible preparations by distinguish regions, for example, Financing fundamentals, Zones of price that should be looked into, Provider conditions that should be renegotiated (Abdelmoneim & Jones, 2014).

Applications

- Assess Accuracy of a Forecast: Precision of the estimate is urgent for basic leadership and distributing assets for a specific task. Distinctive sorts of estimating strategies give diverse dimension of certainty interim and the administration needs to determine whether the utilization of anticipating strategy is fitting for that specific result.

- Money saving advantage Analysis: All in all, if more exertion and assets are placed in, the figure will be increasingly precise. Anyway the cost engaged with going for a complex conjecture should be endorsed given the imperative of assets.

- Timetables of Forecasting: Timetables for figure (choice to make a 5-year estimate or a 10-year measure) is an urgent factor in landing at the exactness of conjecture (Turner & Guilding, 2012). Be that as it may, there is a tradeoff of measure of information included and expanding courses of events, which should be deiced before beginning the determining procedure.

D3

Findings of the report

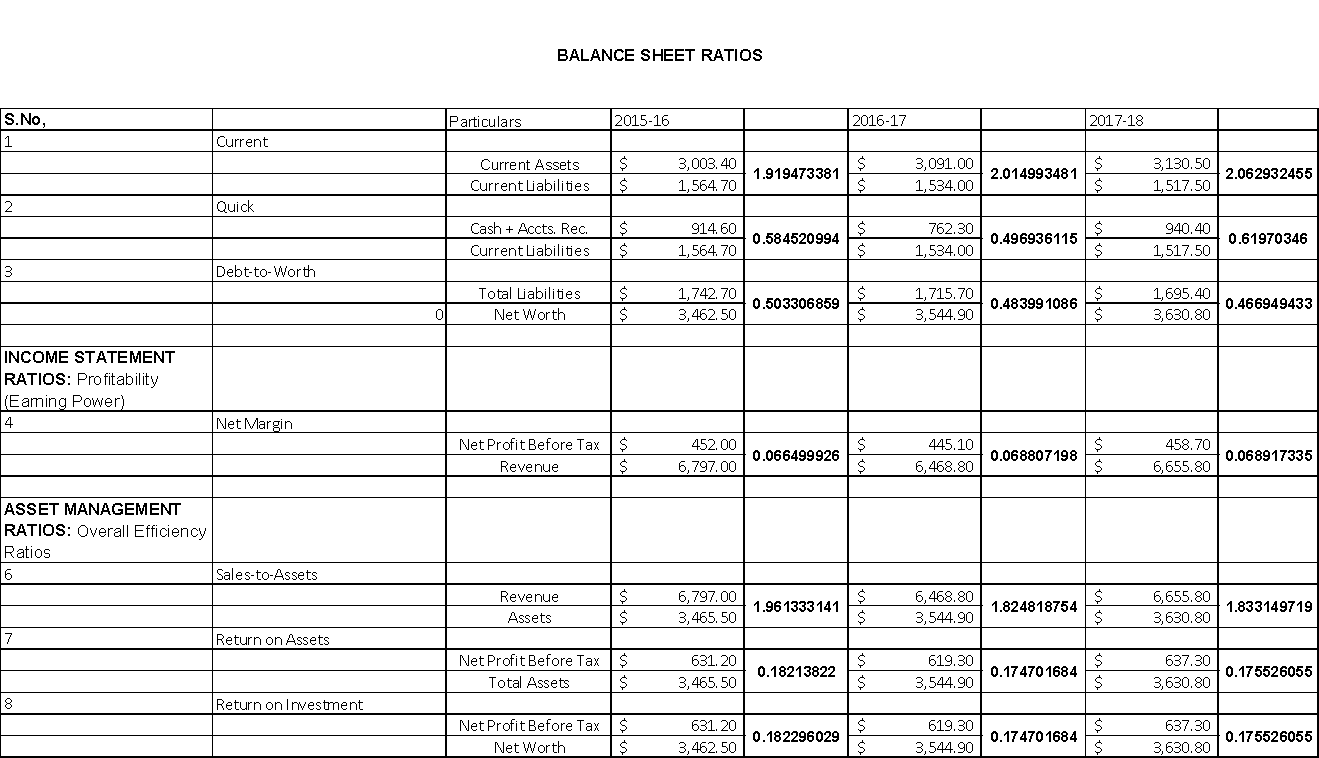

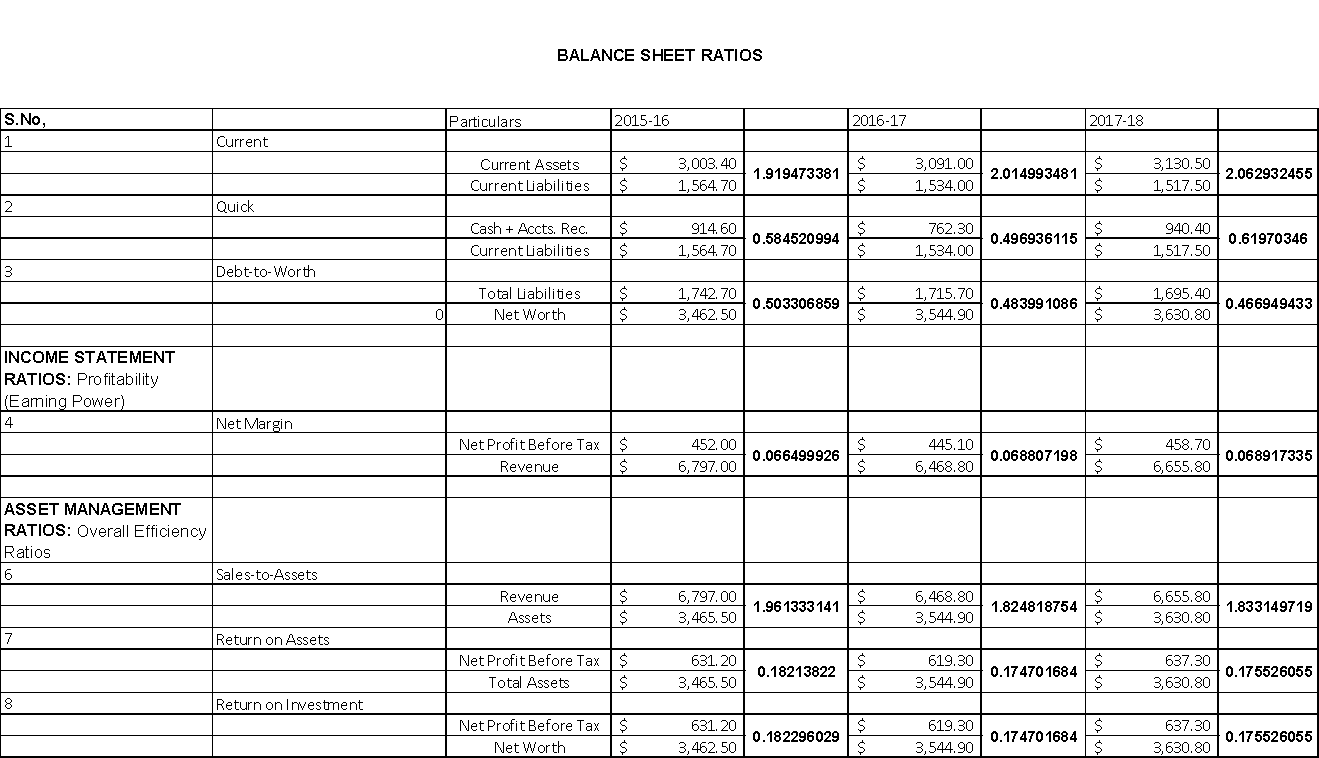

Financial analysis is a very important step, whereas considering an organization’s investment perspective. It is a method of ratio between numerous products in monetary statements. Ratios are classified as advantageous ratios, liquidity ratios, plus utilization ratios, leverage ratios and assessment ratios supported the suggestion they supply. A stability sheet, earning declaration is the foremost essential financial declaration and if properly examined and taken will offers precious visions into an organizations employment (Belfo & Trigo, 2013).

Financial Proportions are usually employed by at this time and capable investors, creditors and financial establishments to judge an organization past achieve spot fashions in a very employment and to match its progress with the common company progress (Abdelmoneim & Jones, 2014). Internally, the controller uses these ratios to watch progress and to line specific aims, objectives, and policy actions.

LO4

P5

Key-performance indicators

KPI stands for the set of some standardized parameters that must be adopted by a company compare the inner performance against applied individual standards. As an associate degree example, most accepted level of short liquidity is 2:1 and, an enterprise can compare liquidity of business against this applied commonplace to analysis the areas of problems.

Through the applying of KPI’s, structural performance is measured against applicable standards (Belfo & Trigo, 2013). It will facilitate identifying the problem containing areas that need improvement. Once the identification of such areas, associate degree economical strategy is made and enforced by management to urge eliminate cash issues and insure property growth.

Benchmarking

This term stands for the tactic that’s expounded to comparison among industry-based-standardized-values and aftereffect of business operations, as an associate degree example, eighteen net profit is assumed higher in Retail market trade of the United Kingdom, so a company is that’s gaining profits eighteen or lots of are assumed smart whereas a corporation that’s not generating profits as per trade commonplace are assumed, low entertainer. Through the applying of benchmarking, a business can improve the internal performance level up to trade parameters to insure sensible profits and enlargement (Cooper. et., al, 2017).

Financial governance

Financial governance is associate in nursing indicator of those moral rules that unit needed to be applied terribly very business corporation to insure security from dirt that may occur due to non-presence of ethical arrangements. Actually, losses from stealing or fraud unit one the key issue for the money problems in business and thus the adoption of economic governance creates Associate in Nursing surroundings of ethics in operation. Also, it ends up within the establishment of sound internal controls in structure, procedures that stops the entity from capital losses (Paulsson, 2012).

M4

Management accounting have basic objective to produce the management for deciding purpose. As merely simply just in case of economic issues, management wants the knowledge relating to increasing. There are a unit type of corporations have the skills to satisfy these challenges and to contend in a very property economy in step with the Environmental Management and Assessment Institute. The Management Report stands to purpose what vary business entities have disappeared into valuable intelligence and analysis by failing to appreciate trait capabilities. This involves the utilization atmosphere for impact and analysis and news on the impact of environmental and economical factors on employment progress. Throughout this case, the senior respondent may have data on this type of knowledge (Belfo & Trigo, 2013). However, there unit of activity indications that it begins to vary, and predicts fraction of the calculable expected growth at intervals subsequent 2 years for environmental and social information. The financial gain forecasts will facilitate predicts forthcoming money shortages to assist them turn out the proper decisions. It will facilitate in tax preparation, developing with new instrumentation purchases or distinctive if they may would like to secure barely business loans (Brooks & Mukherjee, 2013).

Conclusion

From the above discussion, it is known that unethical operating of workers, low performance of employees and inefficient investment coming up with are major factors for the money problems in business entities and, it may be removed through the applying of management accounting tools. Findings of debate are enough to bring to a close that the employment of management register is extremely helpful for business firms within the consummation of targets.

References

Cooper, D.J., Ezzamel, M. and Qu, S.Q., 2017. Popularizing a management accounting idea: The case of the balanced scorecard. Contemporary Accounting Research, 34(2), pp.991-1025.

Abdelmoneim Mohamed, A. and Jones, T., 2014. Relationship between strategic management accounting techniques and profitability–a proposed model. Measuring Business Excellence, 18(3), pp.1-22.

Turner, M.J. and Guilding, C., 2012. Factors affecting biasing of capital budgeting cash flow forecasts: evidence from the hotel industry. Accounting and Business Research, 42(5), pp.519-545.

Belfo, F. and Trigo, A., 2013. Accounting information systems: Tradition and future directions. Procedia Technology, 9, pp.536-546.

Brooks, R. and Mukherjee, A.K., 2013. Financial management: core concepts. Pearson.

Paulsson, G., 2012. The role of management accountants in new public management. Financial Accountability & Management, 28(4), pp.378-394.

Introduction

Protectionist policies are the threat to the free trade at a global level. The situation that occurs with the organisation because of protectionist policies is analysed in context with the trade for this assessment. Trade protectionism is a policy which enables the government to protect and secure the domestic firms from the foreign competition. It helps the domestic firms to get a relative advantage against foreign firms in the domestic market.

Critically evaluate the positive and negative aspects of a more protectionist trade policy for an emerging/ or a mature economy.

Technology and cost of a product

After the globalisation, the multinational companies are free to trade in any part of the world. To protect the local companies some of the countries impose high tariffs, restrictions, subsidies, import quota and other tariffs on the product of foreign companies. The cost of the foreign product in the local market Rises because of huge tariffs. This favour from the local government to the local company in any country provides a competitive advantage to a local company (Goodman, 2018). On the other side in the views of De Bièvre & Poletti, (2015), implementing protectionist measure results in less development of the industry in the particular country. The foreign company can be an advance in Technology and local company may not be advanced. Because of the imposition of higher tariffs on that particular company profit will be less. After that this company will invest less amount in research and development because of let’s profit and a high amount of tax and tariff.

Employment and Competition

As prescribed by Rugman & Verbeke, (2017) the development of local companies can be possible because of the protectionist policies of trade. Local employment can be created because of the survival of the local company. Favour from the local government helps any local company to gain profit and it starts its expansion of business that will help in the creation of more local employment. While as per Durusoy, et. al., (2015), there will be less competition among the organisation because of fever to the local organisations. This will lead to less innovation in the product. Multinational companies outsourcers its work so that profit can be achieved. This outsourcing finishes employment in the non-domestic country. This is also a policy that is implemented by a multinational organisation against countries that implement protectionist measures.

Economy

In the views of Deardorft (2012), slowing down of the economic growth is the situation after the implementation of protection measures by the countries for free trade under globalisation. Product price of MNCs gets increased because of protectionist policies. High prices of the product lead to the customer not to buy MNCs product. Therefore there will be less tax collected by the government. This will lead to slowing down the rate of economic growth. But Durusoy, et. al., (2015), suggested that less competition in the market is the situation then there will be less demand and popularity of the product in the market. This situation also affects sales and hence the economy. Tariffs can be used for the correction of imbalance in the price of production. if any country is providing subsidy on wheat providing local companies then that country can impose tariffs on the MNC that are providing wheat. This will provide an opportunity to earn tax from MNC.

Miscellaneous critical analysis

There has been a lot of discussion about whether protectionism is beneficial or not, let us scrutinizes the pros of this policy.

- One of the important features is that protectionism helps in the regulation of the economy. As the imports decrease, domestic companies face less competition and are able to survive in the market. It will make the domestic economy stronger as it will make the resources put to use to their full potential and hence the firms will be able to produce and supply more to the customers.

- It also helps the emerging businesses to transform themselves at the prevailing market rates as they will not be burdened by foreign competition. These budding firms can build themselves till the time they are strong enough to compete in the global market.

- It creates a feeling of togetherness within the people. This means that the people become more patriotic and work with each other instead of working as a slave in a multinational company.

- It becomes extremely important to impose protectionism in terms of national security, industries like defence, hospitals, prisons, etc. should never be given in the hands of foreign players so that the national security is not attacked in any possible way. In the words of Goodman (2018), There are different types of products that can be developed by implementing protectionist policies. The products of Defence should be developed by any country for its security. If any country depends on a foreign company for its defence products then the serious problem can occur to the nation in the wartime. Therefore it is very necessary to implement this strategy in such type of cases. As per the argument of De Bièvre and Poletti, (2015), defence sector of any country can be made better with the help of innovation by the foreign companies. Therefore protectionist policies should not be implemented. It stops the innovation and development in the Technology for the defence products.

- Free trade runs on the belief that it is beneficial for all the people around the globe, however, in reality, it is distributed unevenly wherein only a few individuals can take advantage of the opportunities and make the most out of them. Protectionism takes care of this problem and narrows the gap in the inequality of income (Milne Publishing, 2018).

- When foreign competition is allowed to enter the domestic market, there is a possibility that national deficits might emerge, protectionism helps in avoiding the emergence of the national deficit.

- Not only does it help in avoiding national deficit but with the help of excise duties and tariffs, the government is able to generate a huge amount of money. For example, the US government was able to generate a total revenue of around $44 billion through the policies of protectionism (Vittana, 2018).

Moving on to the disadvantages of protectionism, some of them are discussed below.

- The prices of the products are increased instead of falling down. The tariffs on imports increase the overall cost of the product which is borne by the customer as companies do not take up the onus of bearing the costs. And domestic firms, on the other hand, increase the prices of their products in order to match up to the foreign prices so that they could make more profit.

- Limited choice is available to the consumer. The consumer has to invest more in local products because of the high price. The development of variety in the products is not accomplished because of protectionist policies implemented by many countries. Protectionism does not provide the customers with a wide range of choices to purchase from, it restricts the choice of the customer and hence the customer might even have to compromise with the quality as foreign products are usually perceived to have a higher quality than local products (Ferdman, 2014).

- Protectionism provides a safe environment to the domestic businesses which make them believe that they will continue to grow, it is only through free trade that a local firm can grow as it needs to compete with the foreign firms and survive in the global environment (UK Essays, 2016).

- Trade protectionism can impede the political relationships between two countries, as when one country imposes tariffs, it might create a negative impact on the other country and hence damage their relationship.

- Protectionism might help a nation to grow in the short run, but in the long run, the economy would begin to lose its efficiency and the innovation would decrease over time (Goodman, 2018).

Conclusion

Protectionist measures are the hurdle in the path of growth of multinational companies in non-domestic countries. Protectionist policies are creating disturbance in the economy at the global level. Protectionist policies are against the globalisation. Protectionist policies help the local organisation to grow. Protectionist policies are having advantages as well as disadvantage both for any country.

References

De Bièvre, D. and Poletti, A., 2015. Judicial politics in international trade relations: Introduction to the special issue. World Trade Review, 14(S1), pp.S1-S11.

Deardorft, A., 2012, July. Easing the burden of non-tariff barriers. In International trade forum (No. 3, p. 26). International Trade Centre.

Durusoy, S., Sica, E. and Beyhan, Z., 2015. Economic Crisis and Protectionism Policies: The Case of the EU Countries. International Journal of Humanities and Social Science, 5(6), p.1.

Ferdman, R. (2014). The Washington Post. [Online] Available at: https://www.washingtonpost.com/news/wonk/wp/2014/12/03/how-the-worlds-biggest-companies-bribe-foreign-governments-in-11-charts/?utm_term=.642a5a509957 [Accessed 27 Oct. 2018].

Goodman, P. (2018). The Pros and Cons of Import Tariffs and Trade Protectionism. [Online] Soapboxie. Available at: https://soapboxie.com/economy/Pros-and-Cons-of-Trade-Protectionism [Accessed 27 Oct. 2018].

Grin.com. (2013). GRIN – The Effects of Bribery and Corruption on Multinational Corporations. [Online] Available at: https://www.grin.com/document/340648 [Accessed 26 Oct. 2018].

Meschi, P. (2009). Government corruption and foreign stakes in international joint ventures in emerging economies. [Online] Ideas.repec.org. Available at: https://ideas.repec.org/a/kap/asiapa/v26y2009i2p241-261.html [Accessed 26 Oct. 2018].

Milnepublishing.geneseo.edu. (2018). 10. Corruption in International Business – Good Corporation, Bad Corporation: Corporate Social Responsibility in the Global Economy. [Online] Available at: https://milnepublishing.geneseo.edu/good-corporation-bad-corporation/chapter/10-corruption-in-international-business [Accessed 26 Oct. 2018].

Rugman, A. and Verbeke, A., 2017. Global corporate strategy and trade policy. Routledge.

UK Essays. (2016). The International Globalization Vs Local Brands Fashion Essay. [Online] Available at: https://www.ukessays.com/essays/fashion/the-international-globalization-vs-local-brands-fashion-essay.php [Accessed 27 Oct. 2018].

Vittana.org. (2018). 13 Most Valid Protectionism Pros and Cons | Vittana.org. [Online] Available at: https://vittana.org/13-most-valid-protectionism-pros-and-cons [Accessed 27 Oct. 2018].

Executive summary

This report is written for the analysis of personal leadership development. I had written this report as a junior team leader in Woolworth’s supermarket. This report will provide information regarding the various steps that can be taken for personal development as a leader. Various skills and competencies can be developed in the individual by the means of information presented in this assessment. This assessment provides various techniques by which self-analysis can be used for the self-development. The communication of an individual can be made good by techniques present in the report.

Introduction

This assessment provides information regarding personal leadership development. The building of self-awareness can be possible with the help of self-development. Various theories of leadership are discussed in this assessment for personal leadership development. The methods by which the team members can be motivated is also analysed in this assessment. The self-awareness can be accomplished in the team member with the help of training. Providing coaching will also be helpful in developing communication skill.

Whitman GROW model and justification for using this model

This model is chosen for the leadership development of me. This model is very beneficial for analysis of need of development in oneself. The different type of goals can be set with the help of a different model with a definite deadline. After setting the goals the reality of the individual can be analysed. The reality is the place at which the particular person stands in leadership. There can be a different type of options that are available for the development of leadership. These options can be listed and used with the help of this model. Obstacles that are present in the way of leadership development in one can be eradicated with the analysis of obstacles. After eradication of obstacles, the options can be converted into the actions for the personal leadership development.

Stages of GROW

Goal

The objectives for the learning and development should be very clear. There should not be any confusion regarding the goal. These are the needs that are required to be developed in any individual.

Reality

The current reality of me can be analysed with the help of this stage. Different type of challenges can also be analysed with the help of this stage.

Obstacle and options

The obstacles that will come in the path of success will be analysed. The options that can be used for the self-development will be analysed in this stage. Steps will also be taken for removing the obstacles.

Way forward

The options that are chosen are converted into actions in this stage. This is the final stage of which Whitman GROW model.

The time period and justification

A total of 2 years of the time period is selected for the leadership development program with the help of Whitman GROW model. Two years of the program will be beneficial and quick for the learning. At this stage of my career, it is very necessary to learn quickly different leadership skills. Learning will be helpful for me to implement the leadership skills with my continuous daily work in the organisation. This learning program will provide me with an opportunity to target future goals of my career.

Self-leadership development to build self-awareness

To know the own mental state it is very necessary to make self-awareness. Self-awareness is helpful in energizing our self. The strength, weakness and tendencies can be analysed with the help of self-awareness. There are various methods that can be used for the self-development that can be helpful in self-awareness.

Positive intent

Defensive mental state is not a good mental state of any individual. If I am in the defensive mental state then it will not be good for me and for my organisation in which I will work. The person should not be judgemental for any of the people (Sowcik, et. al., 2018). The concern and the issues of another person should be listed by me then the further decisions should be taken. This will be helpful for me in reading other person intention.

Mirroring myself and my decisions

Different type of decisions is taken by me regarding my work. All the decisions should be analysed me and the people around me. This will be helpful for me in the analysis of future decision making. The limitations in the present decision making can be analysed and these limitations can be eradicated in the future decision making (Champy, 2009). After that, the future and the results of the past decision can be compared. The positive feedback can be getting after taking constructive steps regarding limitation on the past distance between.

Tough questions can be asked by the team

I am working as a junior team leader in Woolworths Supermarket. Therefore it is my duty to ask important decisions from the team members in my team. The self-analysis from these questions can be accomplished. If my team members are able to answer the tough questions easily then this will show that I am able to make my team understand important things regarding my organisation. They are able to understand the policies that are associated with their work. Tough questions will give their feedback regarding me if they are unable to answer tough questions.

Accountability partner

There is various employees work in the organisation. Any of the employees can become a partner for me. This partner can provide information about positive as well as negative improvement in me. The partner will be accountable regarding my self-development and self-awareness. The accountability partner can be a mentor also. This partner will make sure that I am on the right path of development or not.

It’s not all about me

It is very necessary to analyse that my team is working good for the organisation or not. If I am unable to make them understand the task then they will not work well for the organisation. Therefore it is my duty to make them competent in effective working for the organisation (Champy, 2009). The behaviour of the team members towards me will also show my response and my behaviour towards them. Therefore this self-development provides the analysis of self-awareness regarding own behaviour.

Personal leadership development strategy with leadership Theory

Behavioural theory

It is the type of theory of leadership different type of behaviour can be used by the leader for accomplishing the organisational task. The autocratic behaviour can be used by the leader in the situation when employees are already ready to work. In this situation, the leader only assigned the task to the Employees (Lamm, et. al., 2018). The relational behaviour is implemented by leaders when an important task has to accomplish with the help of the team of the leader. In this situation, the leader provides training to its staff regarding the important task. The different problems that are associated regarding the task are solved by the leader.

This theory will be helpful for my personal leadership development as different behaviours will be understood with the help of this theory. This theory provides the reactions that have to be made by a leader in the different situation with the employees that are working under the leader. This theory will provide me with an opportunity to lead my team efficiently.

Hersey and Blanchard’s approach – Situation theory

There are various types of styles that can be implemented by any leader for accomplishing the work in the organisation. The style can be used according to the situation.

Telling

This is the leadership style that is used in the situation when the task is regular work that is associated with the responsibilities of staff (Globe, 2018). In this style, less relationship is focused by the leader.

Selling

Some of the tasks are there that require coaching as well as supervision. In such type of situation, a leader implements selling is time. Leader trains the team member as well as motivate them to do that work.

Participating

This is the type of leadership style in which relationship is given priority by the leader. The task is least focused on this style. This type of leadership is implemented by the leader when there is less commitment of the team member is shown. In this situation, the leader motivates the team member to work with full of commitment.

Delegating

When the team member is already motivated to do the particular task then this delegating style is implemented by the leader (Lamm, et. al., 2018). In this situation relationship as well as task both is less focused by the leader.

This style of leadership will provide me with a platform to know the method of tackling team member in a different situation. This type of leadership Theory is very useful for the individual that wants to become a good leader. Leadership can be performed by any individual without any issue with the help of this situation theory.

Fiedler’s Least Preferred Co-worker Contingency theory

Different type of contingencies can be possible at the time of working in an organisation. Contingencies can be solved with the cooperation and coordination between the employees. It is very necessary for a leader to take a fast decision in contingencies. There is the various method by which contingency can be minimised at the time of work.

Leader-member relations

If the team member and the leaders are enjoying good relationship then in the situation leader ask the team member to be Cooperative at the time of contingency. The flexibility in the work can be possible from the team member side because of a good relationship between leader and team member.

Task structure

The controlling of the task is in the hands of the leader. If there is contingency takes place in the organisation then prioritisation of the task can be possible. In this situation, the team members should agree to resolve the contingency according to the task urgency.

Leader position power

The leader is having high authority among the team member. Therefore leader should have that personality so that the team member will follow the instruction given by the leader. The same following should be accomplished by the team member at the time of contingency. This will be helpful in resolving the contingency in a fast manner (Globe, 2018).

The above methods provide me with the opportunity to learn the authoritativeness of the leaders. The method by which flexibility among the team members can be implemented is also analysed with the help of this leadership Theory. The solution of the contingency can be analysed easily with the help of coordination and cooperation. This theory provides me with the understanding of coordination and cooperation in the team.

Capacity to motivate others

It is very necessary for the leader to motivate the team members. Effective team working is very necessary for any organisation. The coordination between the team can be implemented with the help of motivation. There can be a different type of methods to motivate the team members. These are: –

Sharing the vision

The organisational vision can be shared to the team member. It is a good step to motivate the employees of the organisation. The employees will able to understand the mission for which the organisation is working. This will be beneficial for the employees to get motivated. They will walk in the direction of the organisational mission. This technique will be helpful for me to make my team good for the organisation.

Appreciation

Appreciation is the techniques that can be learned by me to motivate my team. This will be helpful for me in motivating a team (Lin & Chen, 2018). Appreciations are given to the employee because of a good performance of the employee.

Welcoming new ideas

Different ideas are given by the team members. Ideas from different team members should be welcomed by the leader. If the leader found idea suitable for the organisation then that Idea is implemented. The innovation can be bringing in the organisation with new ideas. This is the leadership style that will make supportive (Javidan, et. al., 2006).

Empower each individual

Little encouragement is very useful buy the leaders. If the encouragement is given to the individual on the small good performance then it will be a quite motivating moment for the team member. Therefore this leadership style will be helpful for me to encourage team members for working on the future challenging task.

Healthy competition

Competition between employees can be created by the leader. This will make the employees enthusiastic. They will work enthusiastically to be in the top of the competition. Competition can be created by me for the completion of the important task with full of commitment by the team member.

Celebrating success

After the accomplishment of the important task, it is very necessary to celebrate success. This can be possible with the help of creating a theme party in the workplace. This type of parties will make me involve efficiently among the team members. Team members will also able to know each other personally is such parties. This will enhance the commitment of team members towards the organisation.

Coach others, receiving and giving feedbacks

Coaching others about the self-awareness and self-leadership development will be helpful in making good communication skills. Pre-preparation before the coaching can be done every day. This will be helpful for an individual to which I will train. Feedbacks from the team members will be connected regarding the change in my skills. Any limitation will be provided by them regarding my skills. I will also able to make constructive changes regarding their personal leadership development by the means of training. For the development of communication skills, various communication techniques can be implemented by me. The development in the communication skills will also be the result because of this training. Feedbacks regarding the communication will also be getting from this training (Hinck, 2017). This training will provide me with an opportunity to improve my communication skills.

Emotional intelligence

It is the analysis of own emotions. The balance can be created between the emotional life and professional life with the help of emotional intelligence. This is the learning that will make me emotionally strong in different situations at the time of working. Emotion can be perceived by the self-analysis. Behaving right according to the situation is the next step. Understanding the emotions of the team member that are associated to be can be possible only with the emotion analysis. Managing the disturbing emotion of other can be possible with the help of an analysis of the situation and emotion both.

Emotional intelligence will benefit me in different aspects. This will help me to develop my leadership styles. Team performance of the organisation can be increased with the help of emotional intelligence. Occupational stress can be decreased with the help of emotional intelligence. This will be helpful for me for not coming into the stress in any critical situation in the workplace. The decision making can be improved the emotional analysis. The ability of leadership enhanced because of all the benefits of emotional intelligence. This intelligence also provides personal wellbeing of an individual (Hinck, 2017). Reduction in staff turnover can be seen because of the analysis of emotional intelligence.

Active listening

An active listener will always be a good communicator. Active listening can be possible with the help of attentiveness among the individual. I will ask the team members to be attentive at the training session that will be given by me. The open-ended question will be asked by my team member. These questions will make me accountable in different situations. Clarification on the different questions will be given by me. I will also ask clarification from others to develop their communication skills. Paraphrasing can be possible with the help of active listening. This will be helpful in making the agreements from another party. Feelings can be reflected with the help of active listening. The feeling of another individual can be analysed with the help of active listening. Summarising the whole conversation can be possible with the help of active listening. In this way, active listening will be helpful for developing my communication skill in different aspects.

Empathy building

This can be possible with the help of listening to others. The viewpoint of the other individual should be considered seriously. This is the main step for building empathy. After welcoming the other viewpoint, it will be validated by me if I found that point suitable for the organisation. My attitude will be examined by me at the situation. The response of the other individual in this situation after validating the idea of that individual should be analysed (Kostina-Ritchey, et. al., 2017). The Other changes that the particular individual wants to implement should also be welcome. This is the technique that will make me learn the ethics that has to be followed by the authority of the leader.

Collecting feedbacks

Feedbacks regarding my learning can be collected from others. Feedback regarding my training can all be collected from the team members. Feedbacks are very essential for the constructive steps that can be taken for improvement.

Reflective practice and continuous learning

The necessary steps that are accomplished in this assessment will be regular. All the steps will be followed by me in a continuous manner. This learning will provide me with an opportunity to understand the new skills continuously. Personal leadership development can be possible only with the steps that are described in this assessment. These steps will provide me with an opportunity to grow in my career.

Conclusion

Self-development of an individual can be possible with the help of self-awareness. Self-awareness is also helpful in building a strong leadership of an individual. The leadership theories also provide learning regarding the leadership styles that can be implemented in the career. The motivation can be helpful for the team members. Motivating others also provides an opportunity to develop leadership skills. Training others will be beneficial for developing communication skills. Leadership can be developed by a continuous process of skill development.

References

- Champy, J. (2009). Authentic leadership. Leader to leader, 2009(54), 39-44.

- Globe. (2018). Global Leadership & Organizational Behavior Effectiveness. [Online] Globe. Available at: https://globeproject.com/results/countries/AUS?menu=country. [Accessed: 29 November 2018].

- Hinck, J. (2017). Designing an Organizational Leadership Development Program: A Case Study Approach. The Journal of Nonprofit Education and Leadership, 7(4).

- Javidan, M., House, R. J., Dorfman, P. W., Hanges, P. J., & De Luque, M. S. (2006). Conceptualizing and measuring cultures and their consequences: a comparative review of GLOBE’s and Hofstede’s approaches. Journal of international business studies, 37(6), 897-914.

- Kostina-Ritchey, E., Velez-Gomez, P., & Dodd, S. L. (2017). STUDENT ASSETS AND COMMITMENT TO LEARNING IN AN AFTERSCHOOL LEADERSHIP DEVELOPMENT PROGRAM: Looking Beyond the Myths. Middle Grades Research Journal, 11(2).

- Lamm, K. W., Sapp, L., & Lamm, A. J. (2018). A Longitudinal Evaluation of Change Leadership within a Leadership Development Program Context. Journal of Leadership Education, 17(3).

- Lin, T. B., & Chen, P. (2018). The Inception of a Curriculum Leadership Development Program in Taiwan: Rationales and Designs. Chinese Education & Society, 51(5), 324-336.

- Sowcik, M., Benge, M., & Niewoehner-Green, J. (2018). A Practical Solution to Developing County Extension Director’s Leadership Skills: Exploring the Design, Delivery and Evaluation of an Online Leadership Development Program. Journal of Agricultural Education, 59(3), 139-153.

Appendix

Planning template

| Activity |

Duration |

Psychometric Result |

| Self-awareness |

3 month |

Able to take quick and fast decision with a positive attitude |

| Behaviour development |

5 month |

Able to behave well with different people |

| Situation tackling |

4 month |

React and do according to the situation that gives a good result for the organisation |

| Contingency handling |

4 month |

Able to eradicate issues and problems in the organisation |

| Motivating other & self-motivation |

3 month |

Commitment and responsible behaviour towards work can be increased |

| Train other for my communication skills |

5 month |

Communication skills can be made better |

Introduction

In this assessment, there is the analysis of the various issues that are with the tourism sector. The main issues that are discussed in this assessment are terrorism, employment and sustainability. All the issues are discussed in this assessment that provides good insight on the topic.

Terrorism

Terrorism is increasing day by day in different parts of the world. Terrorism impacts negatively on the tourism of the world and Australia. Various attacks are taking place in different countries that affect the security of the tourists (Vermeersch, et. al., 2017). Tourist gets feared because of a terrorist attack in a particular country. Countries issues guidelines regarding not to go in the countries for tourism their terrorist attacks are taking place.

Brighton siege

Yacqub shares what’s the 29-year-old Somali Born individual. This person shot a receptionist of a service apartment in the Brighton. This individual was having a connection with ISIS a terrorist group. Later this individual was died because of a police shootout.

Melbourne stabbing attack

In the year 2018, a person set a fire in the utility vehicle in Melbourne. Then this attacker kills one individual on the street. Two other persons were wounded by this individual. The utility vehicle was exploded because of the Fire (Battersby, 2018). This individual was also shot dead in the Shootout by Victorian police.

These are some of the recent attacks that affect the mood and motivation of tourists to visit in Australia. Visa the incidence that can take place with any tourist that visits Australia. Tourism of Australia is considering this issue very seriously. The CEO of tourism in Australia is insisting that these are the tragic events that take place in Australia. The security is one of the main factors that are considered by International travellers coming to Australia. Terrorism in Australia is isolated but it can’t be taken lightly. Involvement of the tour operators in accomplishing the security are the necessary steps that had taken by tourism of Australia for motivating The Tourist. This is step will not affect the tourism of Australia.

Employment

It is one of the main issues in the tourism sector. Employment in tourism is not stable. It varies on the number of tourists visiting the particular country. In the whole world, the types of tourism take place that is seasonal.

Migration

Due to the climate condition Migration of birds take place from one country and continent to other country and continent. This migration creates tourism in a particular country. Therefore in that particular season tourism take place at that location. This is the reason for the seasonal employment in the tourism sector. The people that are associated with tourism have to be unemployed in the non-seasonal time (Smith, 2015). In Western Australia, approximate 175000 Birds come to Australia in the spring. Various types of ducks species and Roebuck Bay come to Australia. The situation creates a seasonal employment to the people that are involved in tourism of bird sanctuaries.

Climatic and geographical condition

The climatic condition of Australia is such that people love to visit in this country from December to February in the summers and from June to August in the winters. Great Barrier Reef is one of the tourist sites in Australia is always remains warm. In the summers the temperature rises to this tourist site up to 90°C. Rainfall is also taken place in plenty of amounts at this region. Therefore people used to visit this site in winters (Wachowiak, 2016). gold cost is always having a good weather condition fall of the Year, therefore, this is the region in which tourist used to come in summers as well as winters but the tourist is absent in the rainy season. Therefore these geographical and climatic conditions affect the employment of the people that are associated with tourism in Australia. The same is the situation with different countries in the world.

Sustainability

Sustainability is another factor that is at risk and became an issue regarding tourism.

Pollution

Pollution is a major threat that is being accomplished at the tourist sites. The Tourist sites are losing their beauty because of pollution. A large number of tourist to the tourist sites is becoming a serious cause of pollution near the tourist sites. Vehicle emission near the tourist sites due to a large number of tourist visit results in pollution. This issue is impacting greatly on the appearance of the tourist sites. All types of pollution like land pollution; air pollution and sound pollution are caused by the large number of tourist at tourist sites (Salazar, 2012). Pollution is one of the main issues that are taking place in tourism.

Resources

Near the tourist sites like natural tourist sites, various natural resources are present. The beauty of these sites is because of the presence of natural resources. A tourist visiting these sites is impacting negatively on the natural resources of the natural site. The Tourist that are doing camping and tracking effects these resources greatly. The beauty of these resources gets affected results in less tourism at these sites in the coming year. The resources are the natural beauty of any tourist sites. Therefore these tourist sites should not be affected at any cost.

Therefore it is very necessary to implement the sustainable development program at these sites so that tourist motivation regarding visiting these sites will remain active. The sustainability of the tourist site can be maintained by the local support also. The awareness programme among the tourists can be developed by the tour operators. These tour operators can also make aware The Tourist regarding not to affect the tourist sites at any cost. Limitation of the vehicles at the tourist sites should also be done so that pollution can be Limited at these sites. This wills the result in none damaging of the sites at any cost (Suhud & Willson, 2016).

Conclusion

It can be concluded that there is the type of issues are there in tourism. A large number of tourist sites is affected by pollution. Seasonal employment is also impacting negatively on the tourism of the world. Terrorism is a threat to tourism.

References

Battersby, J. (2018). Terrorism Where Terror Is Not: Australian and New Zealand Terrorism Compared. Studies in Conflict & Terrorism, 41(1), 59-76.

Salazar, N. B. (2012). Community-based cultural tourism: Issues, threats and opportunities. Journal of Sustainable Tourism, 20(1), 9-22.

Smith, M. K. (2015). Issues in cultural tourism studies. Routledge.

Suhud, U., & Willson, G. (2016). Giving Over Taking/Receiving in Volunteer Tourism.

Vermeersch, L., Willson, G., & Sanders, D. (2017). Climate changes impact on tourism: the attitude of Australia’s Generation Y. Journal of Hospitality Application & Research, 12(2), 24-40.

Wachowiak, H. (Ed.). (2016). Tourism and borders: contemporary issues, policies and international research. Routledge.

Introduction

Innovation is very necessary for any organisation. There are various current trends in any type of industry. Trend changes according to time. Therefore it is necessary to implement the change in the product. This can be helpful with the help of new ideas and innovation. Ideas are implemented for making the product better than the present condition of a particular product. Various problems regarding the products can be solved with the help of innovation (Björkdahl & Holmén, 2013). The productivity of the product can be enhanced with the help of innovation. Apple is having very innovative products. Innovation in the products of Apple results in a large number of sale. This assessment analyses the innovation of Apple. This report provides information that innovation is helpful in making a good offering to reach a large number of customers. Resources can be organised well with the help of innovation in the business.

Types of Innovation – Radical and incremental innovation in smartphone industry

All the devices that are made by smartphone companies are user-friendly. It is not the situation in which users are having trouble of using the devices. The connection of humanness is bringing by smartphones with the technology in the products. This strategy attracts a large number of customer towards this industry. This leads to growth and research on further innovation. It is the thinking of companies that they are designing a product for the human fingers and hands. Smartphone companies are designing their products for the humans not for the code Jockeys (Innovarsity.com, 2018.

Internet connectivity also played a great role in bringing the innovation in this industry. The art and the design in the product attract the customer. The design of the product is inspired by humanity. The human values are embedded in the products in the present smartphones. The product of present companies is the intersection of Science and humanity (Heracleous, 2013).

Radical innovation

It is the type of innovation that has never been experienced by customers. The acceptance of these type of innovations takes time to be accepted in the market. In the smartphone industry, the radical innovations by apple are: –

Formulation of offerings

According to Gershon (2013), Apple is one of the leading Smartphone, laptop and computer manufacturing organisation. This company also manufactures accessories of smartphone, laptop and computers. This organisation is one of the leaders in innovation in the world. This organisation provides unique features in its product. The uniqueness of the product results in innovation. The unique combination of great software involved in hardware results in large customer base for this organisation. Apple is having the ability to create new business species Björkdahl, J. and Holmén, M., 2013that helps in the creation of New Market Niche. Most popular products of Apple are iPhone, MacBook, iTunes, iPod and iPod. These are the products that show the great innovation in offering a product to the customer. The innovation is bringing in the Apple according to Vision and Mission of the organisation. The organisational structure of Apple matches with firm strategy.

Beauty in product

The engineering to the product of this company is accomplished so that beauty in the products can be implemented. The products are designed in such a way that they are good at Eyes. It was the belief of Steve Jobs that human being never holds ugly things in their hand. With this belief beauty in design was brought by Apple.

Incremental innovation

These are the type of innovations that are developed which are already present in the market and experienced by the customers. These innovations are developed in smartphone industry by Apple as: –

Innovative partnerships

Apple creates opportunity in the market for its partner to get a large number of profits. This opportunity can be created by Apple because of innovation. Every new product of Apple is having new innovation (Cheng, et. al., 2014). New innovation creates a difference in the market. This brings the customer to the Apple Store.

Supply chain

Apple over-invest in the supply chain management. Apple has a tendency to launch its product with the new innovation. It is the trend in the market that after the launching of the product, it gets popularised. This can result in a shortage of the product in the market.

4ps model of exploring innovation

Paradigm

Apple manufacturer’s smartphones like iPhone and also manufacturer’s iPod. These products will never be successful if there will be no App Store and iTunes. This is the innovation strategy that is followed by Apple. The app store is the smartphone application store licensed only for Apple products. Apple user can download any of the smartphone apps from App Store. Most of the Smartphone manufacturers are not having their own operating system. They purchase the licence of Play Store for smartphone applications.

Product

The employees of this organisation do face to face discussion regarding the product and its offerings that is made by the company. There can be another way like instant messaging and teleconferencing that can be used for discussing regarding the product. Apple always focuses on creating the product such that positive review can be circulated in media. Apple takes help from an influencer. This company believes in face to face analysis about the product among the employees of the organisation. The opinion can be made by any employee of the organisation regarding the correct (Lehman & Haslam, 2013). This is helpful in making the product very useful for the customer. Various problems and issues regarding the product can be analysed with the help of this discussion. The endless test is conducted by Apple before launching the product in the market. The product is offered to the customer full of analysis. The collaboration is bringing by apple for the promotion of innovation in the product.

Process

The resources of Apple can be managed well with the help of innovation. Apple is having most high price product in the market even then there are higher sales of Apple product in the market. This is because Apple places its product with unique values in the market. This helps in value creation and branding of this organisation. App stores are having innovative apps that are helpful in creating a success story for the products of Apple. A user can easily download the applications from the App Store and use them for their utility (Shuler, et. al., 2012). iPhone get its platform in the world market because of App Store. The strong business model for Apple is because of Association of product with the software and other technology that is also made by Apple. iTunes is used in Smartphone as well as iPods. iTunes is a media player from which online music can be played. iTunes launched on 9th of January 2001. It can be operated in Mac OS. Mac OS is the graphical operating system that is developed by Apple for its product.

There is no permission required for Apple products while using app store and iTunes. Products and the software both are developed by Apple. These are the main resources of Apple hands can be easily managed as developed and operated by Apple only. This business model is creating a large amount of profit for Apple. The applications present in the app store are user-friendly and authenticated. There are very less chance of malware entering in the Smartphone and laptop application of Apple. This creates trust among the customer. This is the milestone example of innovation that is managing its software as well as hardware resources (Innovarsity.com, 2018).

Position

Apple is blessed with employees like Steve Jobs. Innovation is promoted by Steve Jobs in this organisation (Kapoor & Agarwal, 2017). With the help of innovative process the customers can be targeted by the apple at different places like in the seminar, public gatherings. The online advertisements and the TV commercials are also the good tools of targeting the people by Apple. Innovative ideas were welcomed from any of the employees of Apple at the time of Steve Jobs as well as the present by which targeting of the customers can be possible.

Sources of Innovation

Partnership

Apple stores are operated by the franchise of Apple. The growth in the business of Apple results in the growth of partners also. With the help of innovation, partners can be managed as they are also interested in future business with Apple. Therefore it is an innovative strategy that is implemented by Apple for its partner.

Distribution

For no shortage in the market Apple over-invest in the supply chain. Products of Apple are easily available in the market because of innovative supply chain strategy. The demand for pre analysed of the products of Apple. According to the demand-supply of the products are accomplished (Wijaya, 2013).

Nurturing talent among employees

Employees of this organisation help each other in the critical situation regarding Technology. This helps in the development of the technology at Apple. With the help of this coordination, Apple is easily able to manage their staff. When Steve Jobs was the CEO of Apple he always nurtures his employees to take their talent out for the products. The motivation strategy is always followed by since or for the employees of Apple.

HR as executive

The HR department of Apple is treated as an executive department. All the risk that is associated with apple is provided by the HR department of this organisation. Constructive measures that can be taken for mitigating the risk are also provided by the HR department. Effective communication is managed between the employees by this department so that coordination among the employees can be increased (Ngo & O’cass, 2013). This results in effective innovation for the organisation. The human resource of this organisation designed an innovative system. the creativity can be harness among the employees because of the innovative system used by this organisation (Khan, et. al., 2015).

Push and pull influence innovation in Apple

Reaching to customers as push factor

Apple talks to their customer in their language. This helps the customer to feel close to the Apple. This is the strategy that is implemented by Apple attracts a large number of customer. This provides a better customer experience with the customers of Apple. The advertisement for Apple products are made that prospects emotions. The emotion of the common man is in the advertisement of Apple products (Apple, 2018). This creates a sense of belonging among the customers. Influencer is helpful in targeting the relevant audience regarding the products of Apple. The marketing that is accomplished by this organisation is done with the product story. The marketing is done in a simple way that is easily understood by any customer (Apple, 2018). This simplicity helps in targeting the customer easily.

Venture acquisition as pull factor for innovation

The steps are taken as pull factor by the Apple is venture acquisition. The innovation can be bringing in the organisation that will easily attracts the customers. Apple purchased many of the organisations for organising resources and creating innovation. In 1998 network innovation was purchased by Apple. This helps the Apple to get Intel processor in their product. In 1998 Macromedia’s intellectual property was acquired by Apple. At the same time employee team that developed video editing program was also acquired by Apple to establish itself in the video editing market.

The 2005 acquisition with Finger Works helps this organisation in the touch technology by acquiring this company various patents was also acquired by Apple that is used in the iPhone and iPad. The digital advertisement Campaign of the Apple is fulfilled by acquiring the Quattro wireless in 2010. The advertisement in the mobile device can be possible with the help of this organisation. This helps the apple in fulfilling the advertisement strategy. The software application market is based on advertisement and their utility (Innovarsity.com, 2018).

Venture acquisition help in managing the present innovation of Apple. A new innovation in this organisation is also created because of venture acquisition. This new innovation can be managed by that organisation from which acquisition is done by Apple. In this way, various resources that are necessary to develop for Apple can be possible with an acquisition. An acquisition is also creating sustainability for apple. The acquisition helps in the development of new products with effective management of the resources that are needed in developing those products. This development is possible with the help of acquisition only.

Conclusion

Innovation is very necessary for any organisation. Innovation brings new ideas and technologies in the organisation. Innovation also helps in facilitating the business of organisations like apple. With the help of innovative offerings can be made to the customer easily. The method of reaching to the customers can be made simple with the help of innovation. Easy management of the organisational resources can be possible with the help of innovation. Innovation is helpful in creating business growth. This business growth provides a good amount of profits to Apple. The value added to the business can be created with the help of innovation.

References

Apple. 2018. Marketing Resources and Identity Guidelines [Online]. innovarsity.com. Available at: https://developer.apple.com/app-store/marketing/guidelines/. [Accessed: 4 December 2018].

Björkdahl, J. and Holmén, M., 2013. Business model innovation–the challenges ahead. International Journal of Product Development, 18(3/4), pp.213-225.

Cheng, C.C., Yang, C.L. and Sheu, C., 2014. The link between eco-innovation and business performance: a Taiwanese industry context. Journal of Cleaner Production, 64, pp.81-90.

Gershon, R.A., 2013. Digital media innovation and the Apple iPad: Three perspectives on the future of computer tablets and news delivery. Journal of Media Business Studies, 10(1), pp.41-61.

Heracleous, L., 2013. Quantum strategy at apple inc. Organizational Dynamics, 42(2), pp.92-99.

innovarsity.com. 2018. Apple’s Systemic Approach To Innovation. [Online] innovarsity.com. Available at: http://www.innovarsity.com/coach/bp_innovation_strategies_apple.html. [Accessed: 4 December 2018].

Kapoor, R. and Agarwal, S., 2017. Sustaining superior performance in business ecosystems: Evidence from application software developers in the iOS and Android smartphone ecosystems. Organization Science, 28(3), pp.531-551.

Khan, U.A., Alam, M.N. and Alam, S., 2015. A critical analysis of the internal and external environment of Apple Inc. International Journal of Economics, Commerce and Management, 3(6), pp.955-961.

Lehman, G. and Haslam, C., 2013, December. Accounting for the Apple Inc business model: Corporate value capture and dysfunctional economic and social consequences. In Accounting forum (Vol. 37, No. 4, pp. 245-248). Elsevier.

Ngo, L.V. and O’cass, A., 2013. Innovation and business success: The mediating role of customer participation. Journal of Business research, 66(8), pp.1134-1142.

Shuler, C., Levine, Z. and Ree, J., 2012. iLearn II An analysis of the education category of Apple’s app store.

Wijaya, I.M., 2013. The influence of brand image, brand personality and brand awareness on consumer purchase intention of Apple smartphone. Journal EMBA: Jurnal Riset Ekonomi, Manajemen, Bisnis dan Akuntansi, 1(4).

Executive summary

In this assessment measurement of performance for the Samsung is accomplished. The strategies that are involved in the performance management by the Samsung are also analysed. The stakeholders are the main entity of any organisation. The methods that are involved by the Samsung for the management of risk associated with this organisation are also determined in this assessment. The financial performance that is accomplished by this organisation is described in this assessment. The perception of the customers regarding the performance of Samsung is also presented in this assessment. The recommendations that are necessary for the improvement of performance are investigated in this assessment.

Introduction

Performance management is a whole new aspect which starts as soon as an employee enters the organization and ends with the resignation of the employee. Performance management facilitates communication with its employee and helps the organization in measuring the performance of the employee and appraising the employee. Samsung manages the performance of its employee and provides them with incentives to them motivated towards the work. Performance management not only includes the employee performance but also how the organization creates and maintains their stability in the market. How they manage their risk and communicate with their stakeholders. How they react to the feedback and perspective of customers and clients (Chow and Gender, 2015).

It also, makes sure that the operation of Samsung is running effectively and the evaluation and of the performance is done accurately. In the end, the deviations in the performance are analyzed and proper implementation towards it is made.

Organizational performance management and performance measurement

Samsung is a Korean based company offering services to its customers and job opportunity to its employees for 50 years approx. Samsung is the second largest information technology company in terms of revenue in the world. Samsung deals with electronic items like mobiles, laptops, television, refrigerators, etc. The organizational performance management system is the process of analyzing, evaluating and managing the performance of the organization throughout the year. By using the previous data and information, the performance of Samsung’s employee is measured so that the appraisal to the employee could be given. It helps in analyzing that whether the performance of the employee matches with the performance meters set for the employee, and if not, corrections to the policies are made (Grant, 2016).

(Figure: Performance management)

(Source: Grant, 2016)

Performance management is an art of creating an environment where the employees could work with their best of abilities. It focuses on evaluating the performance rate of the employees and helps in communicating with them. It starts when an employee enters an organization and continues until he left the organization. Performance management and performance measurement are related to each other. Samsung makes sure that its employee is working in a coordinated environment where their thoughts are always given a place and they are also motivated for their achievements so that they could give their best performances. Samsung uses the pricing strategy for its employee. Towards the best contribution, the employees are awarded and appraised. Many training and development programs are running in a year and the grievances of the employees are communicated so that they could feel the safe and important in the organization (Chadwick, et. al., 2015).

Performance management helps in the welfare of the employee and thus, develops the skills and standards of its employees. By motivating and waking their initiatives, Samsung could be able to gain effective performance of its employee and thus, the organization. Good performance results in optimum utilization of its resources and help in achieving its objectives effectively and efficiently and thus, helping Samsung, in establishing good brand value in the market.

Communicating performance to stakeholders

Communication is the most important aspect of any business. Samsung makes sure that it communicates with each stakeholder so that it could be able to build good relationships with them.

| Stakeholders |

Promotional schemes |

Communicating ways |

Expectations |

| Employees |

Samsung hires and cultivates talented and skilled people and provides them with adequate training and development throughout the year. It provides time to time performance appraisal to them and provides them with good incentives. |

Multidimensional evaluation,

VOE. |

The welfare of the employees, their development rate, appraisal, and fair compensation. |

| Shareholders |

Samsung understands the importance of its stakeholders and regularly communicates with them via shareholders meetings and minute maids. It helps the shareholders in knowing the issues and also the achievements of the organization, thus helping Samsung in establishing good relationships. |

IR activities,

Meetings of shareholders (Hatch, 2018). |

Cooperation with them, increasing the values of shareholders. |

| Customers |

Samsung values its customers and understands the fact that the customer is its ultimate aim. They aim at providing maximum satisfaction to its employees, by keeping regular communication procedure with its clients. It welcomes the feedback of its customers and always works on it. It treats the customer as part of its organization and adopts new schemes for providing benefits to its employees. |

CS surveys meetings, VOC. |

Increases customer satisfaction and support, aids on providing the protection to the privacy of its customers. |

| Government |

Samsung fulfills all the rules and regulations of the government and maintains healthy relationships with the central power. Through, seminar and conferences, it provides the performance o the company and keeps transparency with the government. It relays on the fact that, with the mutual relationship both the party could grow together. |

Seminars, conferences,

Magazines and newspaper supplies (Basole, 2016). |

Management of governable ethics, legal compliance. |

Risk management

From the recent reports and data, it could be seen that the customers are not satisfied with the performance of the Samsung. Many reports regarding the explosions of the phones have been seen. Hanging on the phone is the main and the most accepted problem in the Samsung products.

(Figure: Risk Management)

(Source – Fainshmidt, et. al., 2016)

Samsung should try to minimize it. Risk management helps the company in managing its risks and moving ahead. Risks directly aim at the downfall of the company. Risk management helps the company in identifying the risks in the company and helps the company in framing new laws and policies for the company so that it could be able to minimize it and rise in the market (Fainshmidt, et. al., 2016).

Quality management and improvement

Quality is something which should not be compromised. Samsung aims at providing quality products at reasonable rates. Samsung says that quality should never be ignored for quantity. By providing qualitative services to its customers, it provides satisfaction to its client and thus, increases its business. Quality management involves the activities where the quality of the product or service is measured and compared to its standards sets, if any deviations occur in that, new protocols are formed, and a better product is supplied (Gruber, et. al., 2015).

Samsung works on achieving excellent quality products so that it could outshine in the market. Samsung deals in electronics items and compromising the quality in this fields leads to the losses and no interest from the customer because of the competition in the market. To gain a successful business, Samsung makes sure that all its operations are qualitative and the work is going on effectively and efficiently.

Financial performance

Samsung has stable financial resources and is the highest revenue earning company in the sector. It aims at quality products at affordable prices which helps in generating customers for the company and thus, helping in increasing revenues of the company. Samsung has achieved able financial goals and is capable of achieving them. Financial performance helps to measure and to maintain the policies and operation of the firm in a year. From the data and information, available it could be seen that revenue of Samsung is increasing year by year and is becoming the top competition for the well-established firms like Apple. In the past years, some of its products saw the downfall in the market, but overall Samsung is working for uplifting its company’s brand and is establishing an excellent track for achieving its financial objectives (Arora, et. al., 2015).

Customer and client perspective

The customer is the ultimate resources of the company. The company is made and ran for its customer. What a customer thinks about the company, matter a lot. Samsung makes sure that its brand image and identity is good in the market. It makes steps for analyzing that its customers are getting what it is conveyed to them and are not framing negative perspective about the company. It is important to maintain healthy relationships with the customers so that, the company could benefit through mouth advertisement. Having a positive mindset of the company, company frames new customers in the market and is able to provide satisfaction to its customers (Ramadan, et. al., 2017).

Samsung achieves mutual relationships with its clients by providing them with high-quality services through a number of channels, previously, customer centers were contacted only when, a problem arises, but now, a minute problem, customer call the call centers and figures out the solution. Samsung should aim at providing excellent customer care services to its customers and gain a positive image in the market.

People Perspective

What brand image a company is forming in the market tells a lot about the performance of the company.

Samsung’s objective is not limited to selling or promoting a product or fixing the product but also; it aims at establishing good relationships with its employees. By building interrelationships, Samsung caters at solving the problems of the customer and providing them with fuller satisfaction. Samsung also aims at providing doorstep services to its customers so that, they could not face problems of loading the products to the repair shops and bear the costs. By delivering amazing services, it helps the company in getting more investments in the wide range of its products by its customer and thus, creating huge profits for the company.

Samsung is well known for its quality products and also at reasonable prices and helps the company in generating new customers every year (Lin, 2017).

Samsung is not only customer oriented company but also focuses on the welfare of its employees. It provides time to time appraisal to its employee and creates good brand value in the market. By giving good incentives and recognition to the employees, the company is able to gain a positive perspective from the people and thus, it will be able to gain social approval.

Implementation issues

Samsung is growing day by day and is adopting new technological advancements in its products. With the fashionable mobile phone to smart television, it is taking over the market. As it is providing amazing products and service to the customer it is charging it from the customer for the same. But, customers face a lot of problems in the product of Samsung and especially in its mobile ranges (Cai, et. al., 2018).

Mobile comes with a handy feature and is now a replica of many activities. But Samsung is compromising in the quality of the product. Problems like battery poor life glitches like bad applications performance upset the customers who are paying the high prices for the same. A most common problem that is seen in the products of Samsung is mobile hanging and automated rebooting. It disturbs the tasks of the customers and impacts the performance of the overall company (Grant, 2016).

According to the technology, Samsung is adopting new advancements, but the portable charging mode is not up to the expectations which make customers, dissatisfied. This issue makes it hard for the company to maintain its performance and harms the image of the company too.

Recommendations for improvement

Although, the Samsung is doing good in the market, its Mobile and tablets range, is not working much in the market due to its bad performance and many other reports like an explosion of the handset and of course, the biggest problem hanging and the battery life of the mobile phone. As a result, decreasing market share of Samsung could be seen and also, dissatisfaction on the side of the customer could be observed.

For grading up the market share and providing the satisfaction to the customer, following are the recommendations on which Samsung could act upon: