Abstract

Corporate or financial accounting means the type of accounting the company has to follow. It will be different for every country as per the corporate laws of the country. The company have to follow all the rules and regulation while drafting annual reports of the company. The guidelines of the format had been described under the laws and the time of that preparation is also mentioned. If the company fails to prepare the report then they were liable to be punished or with the fine.

Introduction

The below assignment is completed with the A2m milk and the Bellamy limited. Both the company are the FMCG Company. The annual reports taken for the consideration is of 2017, 20 18 and 2019. The equity and the liability part of the annual report had been studied to find out the source of funding nomad the reason behind the change of the figures from one year to another. Financial ratios are analysed for both of the organisations in this report. This report provides good idea of the annual report terms of both the organisations.

Part A

-

Items recorded under the owners’ equity section

Bellamy limited Items recorded under the owner’s equity section is

Issued capital: the capital issued to the public either through IPO or through the after issue, or buyback will be included in this

Reserves: the change in any part of the company other than the operation are included in the reserves, it includes the foreign exchange reserves, revaluation reserves and other.

Retained profits: retained profits will include the part of the profits company had retained for the plans.

Non controlling interest: it is the part of the equity which is not held by the Bellamy limited and does not have the right to use it (Bellamy limited, 2019).

A2M milk items under the equity section:

Share capital: the share capital is the number of the shares issued by the company to the pub lice, employees or another member, either by IPO, or buyback will be included.

Retained earnings: this will include the saving of the profits for future management. As per the law, the company has to retained fix % of the profits as restrained earnings

Reserves: reserves will be the fluctuation inactivates under than operating, like hedging instrument (A2M,2019).

-

Movement in each item recorded under the owner equity section with the reason

Bellamy Limited Schedule of Equity Share

The company is having a change in the share capital pattern from 2017 to 2019. The company had issued a share in 2016 to the existing shareholders. As per the annual report of 2019, it was revealed that the company had issued 9,738,250 shares to the investors in 2017 for$ 46,257000. 3,190,042 shares were issued to the subsidiaries company and 708,467shares were under ESOP. At the end of 2019, the company had the 113,368,297 no of shares worth $120, 870000. The shares in 2018 were 113,316,104 worth 120,870 (Bellamy limited, 2019).

On the part of the balance sheet, the issued capital will be the same for all years. Reserves were fluctuated due to the change in foreign exchange and due to the profit and loss for the hedging instruments. The company had not paid any dividend in the current year.

A2M milk

As per the review of the company balance sheet company not had issued any share capital in the current year to the public. But had given the option of the ESOP to the employees.

Out of option raised the 3000998 shares were exercised of the value of $1890000 which were 4,231,000 were exercised in 2018 the value of the exercise was 2666000. The company also issue partly paid share worth $1080 in 2019. The cost of the issue was $41 in 2019 while $52 in 2018.

The company had paid a dividend in the current year as well as the last year

Reserves will include the employee equity-settled payment reserves, fair value reservation reserve and foreign currency translation reserve.

-

Items have been recorded under the liabilities section

Bellamy limited

Liability section is divided under two heads current liability or noncurrent liability

Current liability will include the change in the liabilities due to the operation of the business, it includes trade and payables, changes in the inventory, income tax liability and other

While in current liability will include employee benefits of the company

A2M Milk

As the same, it is also divided infer the two heads

Current liabilities had included the change in trade payables of the operations and other contract liabilities of the customer

While no current liabilities will include the p [arable other than the operations which are the employee’s entitlements

-

The movement in each item recorded under liabilities section with reason

Bellamy limited

The reason for the change is as follows:

Trade and payables: it will include the trade payables, as the suppliers whom the company have to pay for the stock they had purchased

Borrowings: borrowings will include the benefits of the credit card facilities of the company; it will include the secured loan of the company, from the bank. The total secured loan of the company is from either bank the bank facility or the guarantees given. As per the accounting standards, the borrowings are shown at the fair value of the consideration (Bellamy limited, 2019).

Derivative financial instruments: it will include the transition of the hedging, and they are recorded as the fair value on each subsequent re [porting date. The company recorded the net profit and loss in the instrument under the reserves of the company

Income tax: the income tax will be the liability of the tax of the cure net year which will be paid in the next financial year

Employee benefits: this will be the benefits given to the employs, but the employees not entertain the benefits yet

Provision: the provision will include the minimum annual provision. The reason for the change in minimum value.

Employee benefits: employee benefits will include the contingent liabilities of the employees for which the company had made provision.

A2M milk

The A2m milk had included the following liability

Trade payables: it will include the party to whom the company have to pay for the supplies.

Accruals: it had the liabilities company have to pay in the current year but nit paid in the current year, and dwell bow due in the current year.

Employee benefits: it will include the benefits given to the employees and not yet received. It will be recognised on the fair value and change of is the reason is in the fear value and number of the option.

Explain the relative advantages or disadvantages of each source of the fund each of your selected companies is using

Both the company had the capital raised from either from the issue of the capital or through the bank or financial institutions

The advantage is as follows:

Share Capital: the coma pony does not pay any fixed rate of the interest in the share capital, hence it will be beneficial to the company, but the company have to pay a dividend at the end of the year which involves the part of the profits.

Employee stock option: this option is given to the employees to make them retain in the company, in this option the employees can exercise the issue on the issue price on the date of /option given. They can also vest their right if they want

Bank: it is the most secure type of funding. The bank will take a fixed rate of interest but they have fixed maturity periods.

Part b

Concept of small proprietary companies, large proprietary companies and reporting entity.

Proprietary companies are those that are registered under section118, 60180,1362B. if any nature of the companies isis registered under these above mentioned is known as proprietary companies. The proprietary companies are limited by shares, not more than 50 shareholders, and no disclosure is done by a proprietary company in front of the public. These are some condition to become a proprietary company (Hiller, 2013).

Small proprietary companies

Small proprietary companies are the companies that follow all the above-mentioned condition and some additional condition that is

The small proprietary companies are considered small if they earn gross revenue not more or less $10 million in a financial year.

The small proprietary companies are to be under small proprietary if the companies assets turnover is less than $5 million in a financial year.

The small proprietary should consist of not more than 50 non-employees shareholders at the end of the year or financial year.

Hence, if any company is fulfilling a minimum 2 of the following condition they are considered as the small proprietary company as per section 113 (May 2013).

Large proprietary companies

Large proprietary companies are the companies that are fulfilling above mentioned objective that is mentioned in proprietorship clauses and some additional condition also applied to accept the companies as a large proprietary company the condition are

The large proprietary companies are to considered to be large if they earn gross revenue of $10million or more than $10million in the financial year.

The large proprietary companies are considered to be large proprietary under section 113 if their assets turnover is $ 5 million or more than that in the financial year (May 2013).

The large proprietary company should consist of 50 employees or more than that margin in the financial year.

Hence if all the condition is fulfilled by any proprietary companies the company is considered under a large proprietary company and above clauses should be followed by the company every financial year.

Reporting entity companies

Reporting entity companies are the companies that are dependent on the general purpose financial report to develop the understanding of the financial position and performance of the company or the firm or the business entity, the reporting entity also use the understanding to make necessary decision making for the financial aspect of the company. The general users f this portal is the shareholders, members, employees, and potential investors . under this condition all the Australian standard are to be implemented and proposed while understanding the financial report and all the condition that are mentioned in the Australian standards report and conclude the report after covering all the relevant clauses that are related to the particular financial report that is share price , taxation report and another public outcomes that is to followed by the company while building any decision making and framing policies (Kang and Gray, 2013).

The implication of the terms, compliance and reporting requirement in all the above mentioned three types of companies

Small proprietary company

Institutional framework

As per the institutional framework, the small proprietary companies should register themselves under the head proprietorship clauses. The small entity company should not have the rights to disclose any report or share under public report broadcasting and they have to follow all the riles that the framework amends to follows, if any violation occurs in future the laws suggest he punishment as well.The rule violation will cause the closedown of the company, some fine amount should be discharge and the required certificate that is commencement certificate should be incorporated under the proprietorship act. These are all some framework that is suggested by the government of the country (Miglani, et.al., 2015.

Accounting standard

Small entity companies should follow the AASB-series standards that are to allotted by the Australian standard of the country for performing any financial transaction and preparing a financial report. The AASB-series includes the health discussion if in any case required, the small entity companies should also consult the public for processing. The head that comes under AASB- series are Australian securities and commission act 1989 of corporation law (Miglani, et.al., 2015).

Auditing standard

The auditing standard that is followed under the corporation laws is the auditing and assurance standards board. This standard helps the proprietor to develop some professional code and conduct for professionalism framework and maintaining standards in the company and provide assistance to carry financial report ethically and professionally. Hence the auditing body also prescribed the violation condition, so that the person think before doing any evil act.

Large proprietary companies

Accounting standards and auditing standard

The large entity should maintain the gross revenue as mentioned under the proprietary clauses or section. The accounting standard suggests some norms as mentioned under the corporation laws the laws 3expalined that the proprietary business does not consider as the public company. So that they have no right to disclose their investors and shares of the company they take help of the public consultation process for better functioning and report preparation. The Australian accounting standard provides certain guidelines that are to be followed by the large entity companies, otherwise, they will suffer complication in the working and the development of accounting standards raise the standard of the financial senses too and helps the company professional to implement those standards to sustain the quality and working in the organization.

The auditing and assurance standard helps the large proprietary companies to develop ethical processing in the company to carry out financial norms with high standards in auditing policies. The auditing policies also levied rules and restriction for effective functioning (Rahman, 2013).

Reporting entity companies

Accounting standard and auditing standard

Reporting entity company should also follows the relevant standard to maintain the ethical environment in the organization and to prevent company from heavy losses the reporting entity company prefer the GPFR portal or a assistance that helps them to develop understanding of the financial nature and behaviour that needs to maintained the effective financial position and to take relevant and accurate decision making after studying the GPFR reports and prepare the company report as per the study done in the GPFR portal and make changes and implementation accordingly (Gay and Simnett,, 2012).

Conclusion

The study of all the above mentioned clauses reveals that every company whether it is A2M milk companies and Bellamy limited of Australia should follow all the rules and regulation that is amended by the Australian standards under the accounting heads for carry out their financial position and reporting effectively because if they do not implement all the clauses they do not know the nature of their business. For maintaining quality standards and to distribute equal shares to discharge financial responsibility and to implement high standard and ethical working the company needs to follow the guidelines that are amended by the Australian government to carry out financial planning and functioning effectively. Hence for gathering effective and professional financial essence whether it is in the small, large or reporting entity, the company needs to follow the standards for basic formalities, financial years terms and condition, and to maintain consistency in the business.

References

A2M, 2019, Annual report of A2M milk[online] A2M available at: https://thea2milkcompany.com/wp-content/uploads/The-a2-Milk-Company_FY19-Annual-Report_double-pages-1.pdf[access on 29 September 2019]

Bellamy limited, 2019, About investors and share of the company[online] Bellamy, limited available at: https://www.intelligentinvestor.com.au/shares/asx-bal/bellamys-australia-limited[access on 29 September 2019]

Bellamy limited, 2019, Annual report [online] Bellamy limited, available at http://www.annualreports.com/Company/Bellamys-AustraliaLtd[access on 29 September 2019]

Gay, G. and Simnett, R., 2012. Auditing and assurance services in Australia. McGraw-Hill Education Australia.

Hiller, J.S., 2013. The benefit corporation and corporate social responsibility. Journal of Business Ethics, 118(2), pp.287-301.

Kang, H. and Gray, S.J., 2013. Segment reporting practices in Australia: Has IFRS 8 made a difference?. Australian Accounting Review, 23(3), pp.232-243.

May, G.O., 2013. Financial accounting. Read Books Ltd.

Miglani, S., Ahmed, K. and Henry, D., 2015. Voluntary corporate governance structure and financial distress: Evidence from Australia. Journal of Contemporary Accounting & Economics, 11(1), pp.18-30.

Rahman, A.R., 2013. The Australian Accounting Standards Review Board (RLE Accounting): The Establishment of its Participative Review Process. Routledge.

Abstract

Jb Hi Fi Company is founded by John Barbuto. It is a type of retail industry founded 45 years ago in 1974 at Keilor East, Victoria, Australia. This company mainly deals in the products related to customer electronics, major appliances such as domestic appliance for cooking and washing laundry, for food preservation etc and example of small appliances can be said as microwave oven, coffee makers etc. JB Hi Fi is the largest company of home appliances in Australia. It deals in Computers, tablets, mobile phones, TVs and gaming multimedia. The Good Guys is the subsidiary of this company. JB HI FI is located nearly at 303 places including Australia and New Zealand. The headquarters of JB Hi Fi Company is in Tower Two of Vicinity Centre’s Chadstone Shopping Centre, Melbourne, Australia. Gregory Richards being a Chairman of the company and Richard Murray as the CEO forms the two key people of Jb Hi Fi. This company is publically traded in the Australian stock exchange named ASX: JBH. The company ranks 50 out of top 2000 companies running in Australia. All the other relevant information about the company can be referred through the official website of Jb Hi Fi Company https://www.jbhifi.com.au/.

I Introduction

Here we are going to know all about the success policies of JB HI FI. Its financial performance and income statements of the company. Jb Hi Fi is an Australian company, aw we know, one of the largest entertainment retailer of home products. The company deals with major appliances as well as small appliances in a variety of home appliances. Mobile phones, laptops, televisions, gaming microwave ovens, toaster JB Hi Fi are all examples of the company’s flagship and small appliances.

In this assignment, we will go over all the important and salient issues faced by the company in general, their adopted principles, the overall performance measures used, and the performance of the firm’s financial position of JB HI FI Company. We will also analyse the structure of capital, their price to income ratio, non-assets of the company JB hi fi. These performances will set the standards for future targets for the company, will they be able to meet their goals and achieve success in the near future?

We will analyse the changing trends about the Jb Hi Fi Australian Company for the last three year financial ratios of the company. An in-depth study of the company’s performance analysis and success report will be seen. The company’s philosophy and system of work will predict the future. Jb Hi Fi as stated above in this assignment is the real and comparable figures according to the official website of the Australian company. We can get all the necessary information about the company from the company annual report. The referenced material has been updated in the year 2019.

Here we are also going to know the details about the liquidity position of Jb Hi Fi Australian Company. The prices of the shares are updated and regularly assured from the official website of JB HI FI COMPANY https://www.jbhifi.com.au.

II Financial Analysis of selected company

2.1 The key product for Jb Hi Fi Company is electronic household entertainment appliances –

JB Hi Fi Company in Australia deals in household or domestic products, major appliances as well as small appliances. Major appliances such as TVs, laptops are bigger in size and higher in value as compared to small appliances such as coffees machine and microwave oven (Tandon & Malhotra, 2013). The importance of the petroleum products in maintaining the comparative advantages of the company are listed below –

- Safety – The Company properly maintained the safety measures in all the products. Provides healthy and safe working environment for all the employees working in the company. Fair behaviour and strict rules and regulations prevent accidents and ensure safety in the company.

- Diversity – Jb Hi Fi Company has much line of products. They have diverse skills, background, and experience about policies. They are creative and innovative for products. They try to plan and make strategies for creating as well as promotion of the new product.

- Social programs – Company contributes in Helping Hand weekly. Helping hand is the Registered Charitable Trust. This trust has been introduced so that employees donate a limited liability to charity.

- Employee groups – Employee groups are formed for timely awareness and programs relating to the benefits of workplace leadership across Australian businesses.

-

- Complete Disclosure – The director’s focus mainly on the forming up of different strategies and success paths. They want the customers to have the complete disclosure of all the relevant information about the company. Bank, investors, government or the interested parties.

- Risk Identification and Management – The Company conducts the necessary operations for the company to identify the risk and manage between risk and reward.

- E- Waste – All the E- Waste from different stores and operations for the support purposes are recycled. No wastage takes place by the store initiatives. They ensure the impact of wastage on the environment gets reduced with time.

Variable rewards incentives – the reward incentive under the VRP in the case of dishonesty and fraud, the board’s discretion will happen by the clawback. Misstatement of material, breach of material and in some circumstances the board shows negligence (Talari, et. al., 2017). Subject to this, a Group executive will not be eligible to receive VRPaward in respect of performance period.

Note – If, during that period, the executive cease to employed, or has given notice of his or her resignation from employment or has been given notice of termination from employment.

2.2 Identify and conduct a trend analysis with two groups of financial ratios, including liquidity and capital structure of the selected company.

| BALANCE SHEET RATIOS |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| S. No, |

|

Particulars |

2016-17 |

|

2017-18 |

|

2018-19 |

|

| 1 |

Current |

|

|

|

|

|

|

|

|

|

Current Assets |

$ 1,170.70 |

1.321630165 |

$ 1,210.50 |

1.319777584 |

$ 1,276.50 |

1.376874124 |

|

|

Current Liabilities |

$ 885.80 |

$ 917.20 |

$ 927.10 |

| 2 |

Quick |

|

|

|

|

|

|

|

|

|

Cash + Accts. Rec. |

$ 269.40 |

0.304131858 |

$ 276.70 |

0.301679023 |

$ 355.20 |

0.383130191 |

|

|

Current Liabilities |

$ 885.80 |

$ 917.20 |

$ 927.10 |

| 3 |

Debt-to-Worth |

|

|

|

|

|

|

|

|

|

Total Liabilities |

$ 1,598.80 |

0.651959385 |

$ 947.60 |

0.5 |

$ 1,044.10 |

0.5 |

|

0 |

Net Worth |

$ 2,452.30 |

$ 1,895.20 |

$ 2,088.20 |

|

|

|

|

|

|

|

|

|

| INCOME STATEMENT RATIOS: Profitability (Earning Power) |

|

|

|

|

|

|

|

|

| 4 |

Gross Margin |

|

|

|

|

|

|

|

|

|

Gross Profit |

$ 1,230.50 |

0.218638948 |

$ 1,470.10 |

0.214478503 |

$ 1,527.10 |

0.215226981 |

|

|

Sales |

$ 5,628.00 |

$ 6,854.30 |

$ 7,095.30 |

| 5 |

Net Margin |

|

|

|

|

|

|

|

|

|

Net Profit Before Tax |

$ 172.40 |

0.030632552 |

$ 233.20 |

0.034022438 |

$ 249.80 |

0.035206404 |

|

|

Sales |

$ 5,628.00 |

$ 6,854.30 |

$ 7,095.30 |

|

|

|

|

|

|

|

|

|

| ASSET MANAGEMENT RATIOS: Overall Efficiency Ratios |

|

|

|

|

|

|

|

|

| 6 |

Sales-to-Assets |

|

|

|

|

|

|

|

|

|

Sales |

$ 5,628.00 |

2.294988378 |

$ 6,854.30 |

2.723743294 |

$ 7,095.30 |

2.836871776 |

|

|

Total Assets |

$ 2,452.30 |

$ 2,516.50 |

$ 2,501.10 |

| 7 |

Return on Assets |

|

|

|

|

|

|

|

|

|

Net Profit Before Tax |

$ 259.20 |

0.105696693 |

$ 334.50 |

0.13292271 |

$ 358.90 |

0.143496861 |

|

|

Total Assets |

$ 2,452.30 |

$ 2,516.50 |

$ 2,501.10 |

| 8 |

Return on Investment |

|

|

|

|

|

|

|

|

|

Net Profit Before Tax |

$ 259.20 |

0.105696693 |

$ 334.50 |

0.176498523 |

$ 358.90 |

0.17187051 |

|

|

Net Worth |

$ 2,452.30 |

$ 1,895.20 |

$ 2,088.20 |

|

|

|

|

|

|

|

|

|

| ASSET MANAGEMENT RATIOS: Working Capital Cycle Ratios |

|

|

|

|

|

|

|

|

| 9 |

Inventory Turnover |

|

|

|

|

|

|

|

|

|

Cost of Goods Sold |

$ (4,397.50) |

-5.11396674 |

$ (5,384.10) |

-6.042082819 |

$ (5,568.20) |

-6.27968873 |

|

|

Inventory |

$ 859.90 |

$ 891.10 |

$ 886.70 |

| 10 |

Inventory Turn-Days |

|

|

|

|

|

|

|

|

|

360 |

360 |

0.418653332 |

360 |

0.403995062 |

360 |

0.405999774 |

|

|

Inventory Turnover |

$ 859.90 |

$ 891.10 |

$ 886.70 |

| 11 |

Accounts Receivable Turnover |

|

|

|

|

|

|

|

|

|

Sales |

$ 5,628.00 |

28.6266531 |

$ 6,854.30 |

33.48461163 |

$ 7,095.30 |

30.06483051 |

|

|

Accounts Receivable |

$ 196.60 |

$ 204.70 |

$ 236.00 |

Trends:

- Current Ratio is the important ratio of the company. It will show that how company will pay the current liabilities. It is comparatively similar in every year.

- The ratio of liquidity will clear out that the company is viable to pay the liquid liabilities. It should be less than 1. The company is having good liquid ratios, and it is maintained in all the 3 years.

- The ratio of net worth will clear out that at either company assets are justifying with the company equity or not. It should not be overvalued or undervalued. The company is also having similar net worth ratio in all the years.

- The net margin will show the profitability of the company. It will shoe either company is profit making or not (JB HI Fi Group, 2019).

- The return on assets will show that how much of the assets had been utilised. How much profit they are giving.

- All the contribution in equity is from the shareholders, and it also comprises of the retained earnings and reserves.

2.3 Perform a non-current asset analysis

| Carrying Amount end of the year |

2016-17 |

2017-18 |

2018-19 |

| Plant & Equipment |

148.2 |

148.2 |

132.3 |

| Leasehold Improvements |

60 |

60 |

59.2 |

|

|

|

|

| Depreciation |

2016-17 |

2017-18 |

2018-19 |

| Plant & Equipment |

138.5 |

162.4 |

196.3 |

| Leasehold Improvements |

97.3 |

113.9 |

130.2 |

|

|

|

|

| Carrying Amount beg. of the year |

2016-17 |

2017-18 |

2018-19 |

| Plant & Equipment |

114.8 |

148.2 |

148.2 |

| Leasehold Improvements |

61.4 |

60 |

60 |

The fixed assets are consisting of the plant & equipment.

The life of the estimates is as follows:

Leasehold Property: 1 to 15 years

Plant and Equipment: 1.5 to 15 years

The impairment will be done as per the change in circumstances.

2.4 Perform a scenario analysis with data provided

| Average selling price |

$ 25.00 |

|

|

|

| Expected sale |

450000 |

|

|

|

| equipment cost |

$ 2,500,000.00 |

|

|

|

| Residual Value |

$ 500,000.00 |

|

|

|

| Working Capital |

$ 800,000.00 |

|

|

|

| Depreciation |

SLM |

|

|

|

| Variable cost |

$ 15.00 |

|

|

|

| Fixed cost |

$ 450,000.00 |

|

|

|

| Discount rate |

12% |

|

|

|

| Tax Rate |

30% |

|

|

|

|

|

|

|

|

| Year |

1year |

2 year |

3 year |

4 year |

| Sales |

11250000 |

11250000 |

11250000 |

11250000 |

| Variable cost |

6750000 |

6750000 |

6750000 |

6750000 |

| Contribution |

4500000 |

4500000 |

4500000 |

4500000 |

| Fixed cost |

450000 |

450000 |

450000 |

450000 |

| Depreciation |

500000 |

500000 |

500000 |

500000 |

| Operating Profit |

3550000 |

3550000 |

3550000 |

3550000 |

| Tax |

1065000 |

1065000 |

1065000 |

1065000 |

| PAT |

2485000 |

2485000 |

2485000 |

2485000 |

| Depreciation |

500000 |

500000 |

500000 |

500000 |

| Working Capital |

|

|

|

800000 |

| Residual Value |

|

|

|

500000 |

| Free Cash Flows |

2985000 |

2985000 |

2985000 |

4285000 |

| Discounted Value |

0.892857143 |

0.79719 |

0.71178 |

0.63552 |

| Discounted Inflows |

2665178.571 |

2379624 |

2124664 |

2723195 |

|

|

|

|

|

|

|

|

|

|

| Outflow |

$ 3,300,000.00 |

|

|

|

| Inflow |

9892661.302 |

|

|

|

| NRV |

$ 6,592,661.30 |

|

|

|

| Average selling price |

$ 20.00 |

|

|

|

| Expected sale |

450000 |

|

|

|

| equipment cost |

$ 2,500,000.00 |

|

|

|

| Residual Value |

$ 500,000.00 |

|

|

|

| Working Capital |

$ 800,000.00 |

|

|

|

| Depreciation |

SLM |

|

|

|

| Variable cost |

$ 15.00 |

|

|

|

| Fixed cost |

$ 450,000.00 |

|

|

|

| Discount rate |

12% |

|

|

|

| Tax Rate |

|

30% |

|

|

|

|

|

|

|

|

|

| Year |

|

1year |

2 year |

3 year |

4 year |

| Sales |

|

9000000 |

9000000 |

9000000 |

9000000 |

| Variable cost |

|

6750000 |

6750000 |

6750000 |

6750000 |

| Contribution |

|

2250000 |

2250000 |

2250000 |

2250000 |

| Fixed cost |

|

450000 |

450000 |

450000 |

450000 |

| Depreciation |

|

500000 |

500000 |

500000 |

500000 |

| Operating Profit |

|

1300000 |

1300000 |

1300000 |

1300000 |

| Tax |

|

390000 |

390000 |

390000 |

390000 |

| PAT |

|

910000 |

910000 |

910000 |

910000 |

| Depreciation |

|

500000 |

500000 |

500000 |

500000 |

| Working Capital |

|

|

|

|

800000 |

| Residual Value |

|

|

|

|

500000 |

| Free Cash Flows |

|

1410000 |

1410000 |

1410000 |

2710000 |

| Discounted Value |

|

0.892857143 |

0.79719 |

0.71178 |

0.63552 |

| Discounted Inflows |

|

1258928.571 |

1124043.367 |

1003610.149 |

1722254 |

|

|

|

|

|

|

|

|

|

|

|

|

| Outflow |

|

$ 3,300,000.00 |

|

|

|

| Inflow |

|

5108836.081 |

|

|

|

| NRV |

|

$ 1,808,836.08 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Average selling price |

$ 25.00 |

|

|

|

| Expected sale |

360000 |

|

|

|

| equipment cost |

$ 2,500,000.00 |

|

|

|

| Residual Value |

$ 500,000.00 |

|

|

|

| Working Capital |

$ 800,000.00 |

|

|

|

| Depreciation |

SLM |

|

|

|

| Variable cost |

$ 15.00 |

|

|

|

| Fixed cost |

$ 450,000.00 |

|

|

|

| Discount rate |

12% |

|

|

|

| Tax Rate |

|

30% |

|

|

|

|

|

|

|

|

|

| Year |

|

1year |

2 year |

3 year |

4 year |

| Sales |

|

9000000 |

9000000 |

9000000 |

9000000 |

| Variable cost |

|

5400000 |

5400000 |

5400000 |

5400000 |

| Contribution |

|

3600000 |

3600000 |

3600000 |

3600000 |

| Fixed cost |

|

360000 |

360000 |

360000 |

360000 |

| Depreciation |

|

500000 |

500000 |

500000 |

500000 |

| Operating Profit |

|

2740000 |

2740000 |

2740000 |

2740000 |

| Tax |

|

822000 |

822000 |

822000 |

822000 |

| PAT |

|

1918000 |

1918000 |

1918000 |

1918000 |

| Depreciation |

|

500000 |

500000 |

500000 |

500000 |

| Working Capital |

|

|

|

|

800000 |

| Residual Value |

|

|

|

|

500000 |

| Free Cash Flows |

|

2418000 |

2418000 |

2418000 |

3718000 |

| Discounted Value |

|

0.892857143 |

0.79719 |

0.71178 |

0.63552 |

| Discounted Inflows |

|

2158928.571 |

1927614.796 |

1721084.639 |

2362856 |

|

|

|

|

|

|

|

|

|

|

|

|

| Outflow |

|

$ 3,300,000.00 |

|

|

|

| Inflow |

|

8170484.222 |

|

|

|

| NRV |

|

$ 4,870,484.22 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Average selling price |

$ 25.00 |

|

|

|

| Expected sale |

450000 |

|

|

|

| equipment cost |

$ 2,500,000.00 |

|

|

|

| Residual Value |

$ 500,000.00 |

|

|

|

| Working Capital |

$ 800,000.00 |

|

|

|

| Depreciation |

SLM |

|

|

|

| Variable cost |

$ 29.80 |

|

|

|

| Fixed cost |

$ 450,000.00 |

|

|

|

| Discount rate |

12% |

|

|

|

| Tax Rate |

|

30% |

|

|

|

|

|

|

|

|

|

| Year |

|

1year |

2 year |

3 year |

4 year |

| Sales |

|

11250000 |

11250000 |

11250000 |

11250000 |

| Variable cost |

|

13410000 |

13410000 |

13410000 |

13410000 |

| Contribution |

|

-2160000 |

-2160000 |

-2160000 |

-2160000 |

| Fixed cost |

|

450000 |

450000 |

450000 |

450000 |

| Depreciation |

|

500000 |

500000 |

500000 |

500000 |

| Operating Profit |

|

-3110000 |

-3110000 |

-3110000 |

-3110000 |

| Tax |

|

-933000 |

-933000 |

-933000 |

-933000 |

| PAT |

|

-2177000 |

-2177000 |

-2177000 |

-2177000 |

| Depreciation |

|

500000 |

500000 |

500000 |

500000 |

| Working Capital |

|

|

|

|

800000 |

| Residual Value |

|

|

|

|

500000 |

| Free Cash Flows |

|

-1677000 |

-1677000 |

-1677000 |

-377000 |

| Discounted Value |

|

0.892857143 |

0.79719 |

0.71178 |

0.63552 |

| Discounted Inflows |

|

-1497321.429 |

-1336894.133 |

-1193655.476 |

-239590 |

|

|

|

|

|

|

|

|

|

|

|

|

| Outflow |

|

$ 3,300,000.00 |

|

|

|

| Inflow |

|

-4267461.352 |

|

|

|

| NRV |

|

$ (7,567,461.35) |

|

|

|

|

|

|

|

|

|

| Worst Case |

|

|

|

|

|

|

|

|

|

|

|

| Average selling price |

$ 25.00 |

|

|

|

| Expected sale |

450000 |

|

|

|

| equipment cost |

$ 2,500,000.00 |

|

|

|

| Residual Value |

$ 500,000.00 |

|

|

|

| Working Capital |

$ 800,000.00 |

|

|

|

| Depreciation |

SLM |

|

|

|

| Variable cost |

$ 15.00 |

|

|

|

| Fixed cost |

$ 550,000.00 |

|

|

|

| Discount rate |

12% |

|

|

|

| Tax Rate |

|

30% |

|

|

|

|

|

|

|

|

|

| Year |

|

1year |

2 year |

3 year |

4 year |

| Sales |

|

11250000 |

11250000 |

11250000 |

11250000 |

| Variable cost |

|

6750000 |

6750000 |

6750000 |

6750000 |

| Contribution |

|

4500000 |

4500000 |

4500000 |

4500000 |

| Fixed cost |

|

$ 550,000.00 |

$ 550,000.00 |

550000 |

550000 |

| Depreciation |

|

500000 |

500000 |

500000 |

500000 |

| Operating Profit |

|

3450000 |

3450000 |

3450000 |

3450000 |

| Tax |

|

1035000 |

1035000 |

1035000 |

1035000 |

| PAT |

|

2415000 |

2415000 |

2415000 |

2415000 |

| Depreciation |

|

500000 |

500000 |

500000 |

500000 |

| Working Capital |

|

|

|

|

800000 |

| Residual Value |

|

|

|

|

500000 |

| Free Cash Flows |

|

2915000 |

2915000 |

2915000 |

4215000 |

| Discounted Value |

|

0.892857143 |

0.79719 |

0.71178 |

0.63552 |

| Discounted Inflows |

|

2602678.571 |

2323820.153 |

2074839.422 |

2678709 |

|

|

|

|

|

|

| Sensitivity Analysis |

|

|

|

|

|

| Outflow |

|

$ 3,300,000.00 |

|

|

|

| Inflow |

|

9680046.847 |

|

|

|

| NRV |

|

$ 6,380,046.85 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Unit Drivers |

|

|

Expected NRV |

Revised NRV |

Change in % |

| Unit Sales (-20%) |

|

|

$ 6,592,661.30 |

$ 1,808,836.08 |

73% |

| Per Unit (-20%) |

|

|

$ 6,592,661.30 |

$ 4,870,484.22 |

26% |

| Variable Cost (+20%) |

|

|

$ 6,592,661.30 |

$ (7,567,461.35) |

215% |

| Cash Fixed Cost (+100000) |

|

|

$ 6,592,661.30 |

$ 6,380,046.85 |

3% |

Good Case

| Average selling price |

$ 30.00 |

|

|

|

| Expected sale |

450000 |

|

|

|

| equipment cost |

$ 2,500,000.00 |

|

|

|

| Residual Value |

$ 500,000.00 |

|

|

|

| Working Capital |

$ 800,000.00 |

|

|

|

| Depreciation |

SLM |

|

|

|

| Variable cost |

$ 15.00 |

|

|

|

| Fixed cost |

$ 450,000.00 |

|

|

|

| Discount rate |

12% |

|

|

|

| Tax Rate |

|

30% |

|

|

|

|

|

|

|

|

|

| Year |

|

1year |

2 year |

3 year |

4 year |

| Sales |

|

13500000 |

13500000 |

13500000 |

13500000 |

| Variable cost |

|

6750000 |

6750000 |

6750000 |

6750000 |

| Contribution |

|

6750000 |

6750000 |

6750000 |

6750000 |

| Fixed cost |

|

450000 |

450000 |

450000 |

450000 |

| Depreciation |

|

500000 |

500000 |

500000 |

500000 |

| Operating Profit |

|

5800000 |

5800000 |

5800000 |

5800000 |

| Tax |

|

1740000 |

1740000 |

1740000 |

1740000 |

| PAT |

|

4060000 |

4060000 |

4060000 |

4060000 |

| Depreciation |

|

500000 |

500000 |

500000 |

500000 |

| Working Capital |

|

|

|

|

800000 |

| Residual Value |

|

|

|

|

500000 |

| Free Cash Flows |

|

4560000 |

4560000 |

4560000 |

5860000 |

| Discounted Value |

|

0.892857143 |

0.79719 |

0.71178 |

0.63552 |

| Discounted Inflows |

|

4071428.571 |

3635204.082 |

3245717.93 |

3724136 |

|

|

|

|

|

|

|

|

|

|

|

|

| Outflow |

|

$ 3,300,000.00 |

|

|

|

| Inflow |

|

14676486.52 |

|

|

|

| NRV |

|

$ 11,376,486.52 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Average selling price |

$ 25.00 |

|

|

|

| Expected sale |

540000 |

|

|

|

| equipment cost |

$ 2,500,000.00 |

|

|

|

| Residual Value |

$ 500,000.00 |

|

|

|

| Working Capital |

$ 800,000.00 |

|

|

|

| Depreciation |

SLM |

|

|

|

| Variable cost |

$ 15.00 |

|

|

|

| Fixed cost |

$ 450,000.00 |

|

|

|

| Discount rate |

12% |

|

|

|

| Tax Rate |

|

30% |

|

|

|

|

|

|

|

|

|

| Year |

|

1year |

2 year |

3 year |

4 year |

| Sales |

|

13500000 |

13500000 |

13500000 |

13500000 |

| Variable cost |

|

8100000 |

8100000 |

8100000 |

8100000 |

| Contribution |

|

5400000 |

5400000 |

5400000 |

5400000 |

| Fixed cost |

|

540000 |

540000 |

540000 |

540000 |

| Depreciation |

|

500000 |

500000 |

500000 |

500000 |

| Operating Profit |

|

4360000 |

4360000 |

4360000 |

4360000 |

| Tax |

|

1308000 |

1308000 |

1308000 |

1308000 |

| PAT |

|

3052000 |

3052000 |

3052000 |

3052000 |

| Depreciation |

|

500000 |

500000 |

500000 |

500000 |

| Working Capital |

|

|

|

|

800000 |

| Residual Value |

|

|

|

|

500000 |

| Free Cash Flows |

|

3552000 |

3552000 |

3552000 |

4852000 |

| Discounted Value |

|

0.892857143 |

0.79719 |

0.71178 |

0.63552 |

| Discounted Inflows |

|

3171428.571 |

2831632.653 |

2528243.44 |

3083534 |

|

|

|

|

|

|

|

|

|

|

|

|

| Outflow |

|

$ 3,300,000.00 |

|

|

|

| Inflow |

|

11614838.38 |

|

|

|

| NRV |

|

$ 8,314,838.38 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Average selling price |

$ 25.00 |

|

|

|

| Expected sale |

450000 |

|

|

|

| equipment cost |

$ 2,500,000.00 |

|

|

|

| Residual Value |

$ 500,000.00 |

|

|

|

| Working Capital |

$ 800,000.00 |

|

|

|

| Depreciation |

SLM |

|

|

|

| Variable cost |

$ 12.00 |

|

|

|

| Fixed cost |

$ 450,000.00 |

|

|

|

| Discount rate |

12% |

|

|

|

| Tax Rate |

|

30% |

|

|

|

|

|

|

|

|

|

| Year |

|

1year |

2 year |

3 year |

4 year |

| Sales |

|

11250000 |

11250000 |

11250000 |

11250000 |

| Variable cost |

|

5400000 |

5400000 |

5400000 |

5400000 |

| Contribution |

|

5850000 |

5850000 |

5850000 |

5850000 |

| Fixed cost |

|

450000 |

450000 |

450000 |

450000 |

| Depreciation |

|

500000 |

500000 |

500000 |

500000 |

| Operating Profit |

|

4900000 |

4900000 |

4900000 |

4900000 |

| Tax |

|

1470000 |

1470000 |

1470000 |

1470000 |

| PAT |

|

3430000 |

3430000 |

3430000 |

3430000 |

| Depreciation |

|

500000 |

500000 |

500000 |

500000 |

| Working Capital |

|

|

|

|

800000 |

| Residual Value |

|

|

|

|

500000 |

| Free Cash Flows |

|

3930000 |

3930000 |

3930000 |

5230000 |

| Discounted Value |

|

0.892857143 |

0.79719 |

0.71178 |

0.63552 |

| Discounted Inflows |

|

3508928.571 |

3132971.939 |

2797296.374 |

3323760 |

|

|

|

|

|

|

|

|

|

|

|

|

| Outflow |

|

$ 3,300,000.00 |

|

|

|

| Inflow |

|

12762956.43 |

|

|

|

| NRV |

|

$ 9,462,956.43 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Average selling price |

$ 25.00 |

|

|

|

| Expected sale |

450000 |

|

|

|

| equipment cost |

$ 2,500,000.00 |

|

|

|

| Residual Value |

$ 500,000.00 |

|

|

|

| Working Capital |

$ 800,000.00 |

|

|

|

| Depreciation |

SLM |

|

|

|

| Variable cost |

$ 15.00 |

|

|

|

| Fixed cost |

$ 550,000.00 |

|

|

|

| Discount rate |

12% |

|

|

|

| Tax Rate |

|

30% |

|

|

|

|

|

|

|

|

|

| Year |

|

1year |

2 year |

3 year |

4 year |

| Sales |

|

11250000 |

11250000 |

11250000 |

11250000 |

| Variable cost |

|

6750000 |

6750000 |

6750000 |

6750000 |

| Contribution |

|

4500000 |

4500000 |

4500000 |

4500000 |

| Fixed cost |

|

$ 550,000.00 |

$ 550,000.00 |

550000 |

550000 |

| Depreciation |

|

500000 |

500000 |

500000 |

500000 |

| Operating Profit |

|

3450000 |

3450000 |

3450000 |

3450000 |

| Tax |

|

1035000 |

1035000 |

1035000 |

1035000 |

| PAT |

|

2415000 |

2415000 |

2415000 |

2415000 |

| Depreciation |

|

500000 |

500000 |

500000 |

500000 |

| Working Capital |

|

|

|

|

800000 |

| Residual Value |

|

|

|

|

500000 |

| Free Cash Flows |

|

2915000 |

2915000 |

2915000 |

4215000 |

| Discounted Value |

|

0.892857143 |

0.79719 |

0.71178 |

0.63552 |

| Discounted Inflows |

|

2602678.571 |

2323820.153 |

2074839.422 |

2678709 |

|

|

|

|

|

|

|

|

|

|

|

|

| Outflow |

|

$ 3,300,000.00 |

|

|

|

| Inflow |

|

9680046.847 |

|

|

|

| NRV |

|

$ 6,380,046.85 |

|

|

|

|

|

|

|

|

|

| Sensitivity Analysis |

|

|

|

|

|

| Unit Drivers |

|

|

Expected NRV |

Revised NRV |

Change in % |

| Unit Sales (-20%) |

|

|

$ 6,592,661.30 |

$ 11,376,486.52 |

-73% |

| Per Unit (-20%) |

|

|

$ 6,592,661.30 |

$ 8,314,838.38 |

-26% |

| Variable Cost (+20%) |

|

|

$ 6,592,661.30 |

$ 9,462,956.43 |

-44% |

| Cash Fixed Cost (+100000) |

|

|

$ 6,592,661.30 |

$ 6,380,046.85 |

3% |

2.5 Identify and discuss any latest share or bond issuance by the selected company

JB Hi Fi Company is officially listed on Australia Stock Exchange on 23/10/2003. The issuer code of the company is JBH. According to the rating companies risks are balanced. The shares applied in 2019 have been raised 50%. The stock price have been listed recently is ₹ 34.860 with the increase of Rs +0.520 and +1.51% has been raised according to the relevant sources referred by the JB HI FI company. The company’s trends changes and fluctuations takes place.

Jb Hi Fi Company has been operated as a listed holding company in Australia. The company consists of most popular and trusted retail brands of home appliances whether major appliances and small appliances, home entertainment appliances etc are operated mainly in Australia (Goldstein, et. al., 2017). These brands are JB HI-FI and The Good Guys. The Good Guys is the subsidiary company of JB HI-FI Company. The capital structure of the company can be analyzed by latest statistics referred from the Wall Street Journal.

- Total Debt to Total Equity has been checked as 42.06.

- Total Debt to Total Capital is seen as 29.60.

- Total Debt to Total Assets ratios has been got 17.23.

- Interest Coverage received as 31.78

- Long-Term Debt to Equity Ratio we got is as 42.06.

- Long-Term Debt to Total Capitalism 29.60.

- Long-Term Debt to Assets ratio by the company is 0.17.

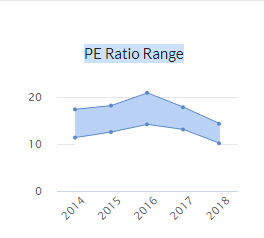

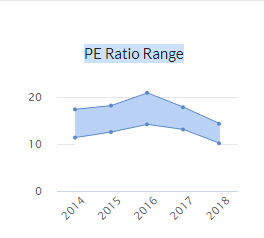

2.6 Calculate and discuss the PE ratios and share price movement of the selected company through 3 years.

PE Ratio means the price earnings ratio. The company PE ratio will show the actual market position of the company (Becker & Ivashina, 2015).The Highest the PE ratio the highest the company valuation. The company use this as an important analytical tool for the investors. It will be calculates as

P/E Ratio = Earnings per share / Market value per share

The PE ratio of the year 2019 is 16.0. This will show that the company is having good financial position and will have good image in the market.

The following graph will show you the movement of the PE ratio in the last years

(Figure: PE ratio)

(Source: Stockpedia, 2019)

III Recommendation letter

It is recommended that the Jb Hi Fi Australian Company to all the investors as it follows all the basic and ethical behaviour and code of conduct necessary to follow by everyone. The directors, staff and employees expect all the guidelines are followed. As we have look upon the comprehensive examination and analysed the firm’s financial performance from the updated financial statements of JB Hi Fi Australia.

This time company is growing with the increasing trend. The only competitor in front of JBH is KGN that’s Kogan limited. This time the sales have been hiked 3.5% to 7.1% billion in 2019. In order to have safe and easy returns investors can invest in the company.

Being an investment analyst, it is recommended to all the investors to invest in the Jb Hi Fi.The Company is performing well in the year 2019 and can write many stories of success in the upcoming years. The share price fluctuations are normal of JB HI FI. Company is viable to pay the liquid liabilities.

After going through a quick replay of the above questions, PEratiooftheyear2019is16.0it is clear that company is having good financial position and have good image in the market.

IV Conclusions

JB Hi Fi Company is a progressive company. It has set a benchmark for all those who wish to invest in home appliances products such as electronic appliances whether major or small appliances belonging to the company under the name JB Hi Fi. According to the statistical analysis we can say that company shows the best work done in 2019. We came to know about all the details of the company, because we studied the entire financial situation thoroughly.

The data has been researched and finalized with an accurate analysis of its condition, leading to the conclusion that JB Hi Fi has a strong position in Australia. In 2018, the price to income ratio was 18 xs. The higher the price to income ratio, the more optimistic the buyer will be about the company’s future performance. A company can reduce the price to income ratio by purchasing debt and spending cash. If the price to income ratio increases then it is better to deal in other companies rather than Jb Hi Fi Australia company.

References

- Becker, B., & Ivashina, V. (2015). Reaching for yield in the bond market. The Journal of Finance, 70(5), 1863-1902.

- Goldstein, I., Jiang, H., & Ng, D. T. (2017). Investor flows and fragility in corporate bond funds. Journal of Financial Economics, 126(3), 592-613.

- Huo, B. (2012). The impact of supply chain integration on company performance: an organizational capability perspective. Supply Chain Management: An International Journal, 17(6), 596-610.

- JB HI FI GROUP. (2019). Reports. [Online]. JB HI FI GROUP. http://annualreports.com/HostedData/AnnualReportArchive/J/ASX_JBH_2017.pdf [Accessed on 20.09.2019].

- Stockpedia. (2019).PE ratio. [Online] Stockpedai. Available at https://investors.jbhifi.com.au/wp-content/uploads/2019/08/4E_FY19.pdf. [Accessed on 20.09.2019].

- Talari, S., Shafie-Khah, M., Siano, P., Loia, V., Tommasetti, A., & Catalão, J. (2017). A review of smart cities based on the internet of things concept. Energies, 10(4), 421.

- Tandon, K., & Malhotra, N. (2013). Determinants of stock prices: Empirical evidence from NSE 100 companies. International Journal of Research in Management & Technology (IJRMT), ISSN, 2249, 9563.

Executive summary

Aristocratic leisure limited company is the Australia based company that deals in manufacturer of a Casino gaming system, and also provide international game technology. Aristocratic Leisure Company is the leader. The company gained 60 per cent share in the market to become the leader of the country. Aristocratic Leisure Company not only provides equipment to the company that deals with gaming system but also provide furniture and the major equipment to the other company also. The company also deals globally too as they support and supply the gaming system, and manufacture the furniture and equipment that is relevant to the casino based industry or gaming industry the country such as New Zealand, Japan, Europe and South American countries. They build a link between these country and supply material and equipment to them. The company is listed in the Australian stock exchange. In 2002 Aristocratic earn $976 million.

The company basic distribution or supply deals in the floor model type of equipment in the market. The company expanding its business and keep concentrate on producing large scale market by fulfilling the existing market demand and by structuring the future market for the company. The aristocratic leisure limited company will do all the above things by making strategies and forecasting and by implementing continuous improvement and by strategizing innovation.

Hence through this aristocratic leisure limited company will become the market leader and keep sustain this position by implementing the new and innovative strategies. Thus, they will taste the feeling of the market leader.

Company background

Aristocratic leisure limited company is the Australian based company that deals in manufacturing the gaming system for the casino and poker games and also develop and innovate the design time to time as according to the changes in the market and customer urging. Aristocratic leisure limited company is the market leader of a particular market. Aristocratic leisure limited company is the company that focuses on designing innovative gaming system that fascinates the audience and the customer and stimulate them to play it. Aristocratic leisure limited company becomes the leader of the market by sustaining 60 per cent market share. The company is also listed in Australia stock exchange.

Aristocratic leisure limited company not only provides a gaming system to the other company but also provide technical support too. The games that are virtually visible but also exist in actual version such as poker and casino game ranges are covered both digital as well as an existing market too. The customer usually plays this game for fun and for following their luck factor to earn money and pleasure by playing these games. The company diversified its market into different origins such as the diversification done as per the market structure and customer preferences. The company also provide furniture and gaming equipment with the innovative and exciting and attractive design model.

Hence, aristocratic leisure limited company as its name suggest the occupation of the company, the company have done proper branding as the person understand before buying the product, the company services and the product they deal in. The aristocratic company keep delivering their product overseas also as they building a link between the companies and also build collaboration that leads to increase the market value and the benefit of gaining trust from the shareholders and investors.

Thus, the company aims is to accomplish the present objective and building trust and simultaneously the company needs to focus on the planning and decision making to become the market leader and sustain that position in their upcoming years.

Business strategy analysis

The business strategy analysis is done with the help of porter fiver force models that reflect some point that helps to know the exact view and the strategy the is followed by the aristocratic leisure limited company is beneficial for firm growth or not. The company should aware of their competitor, customer, supplier and the substitute for their product so that they can make better arrangement and adjustment in their strategy to sustain that existing position and build their company position strong (Morden,2016).

Porter five force models are as follows:

(Sources: Aithal, 2016)

These are the five force model element that leads to analysing business strategy:

The entry of new substitute product:

The entry of the new substitute for the company product is the threat for the leading company as if the substitute will increase the threat will also increase on the company as it leads to diminishing the market share of the company. the company will face active competition with these substitute as the product quality differ but the efficiency that the company bring sis the same as in the case of the substitute product. So, because of this the substitute product entry will grab the customer that have less affordability power and lessen the chance of diverting this customer towards the company. Hence, to maintaining the flows and structuring the new customer is aware of the number of Substitute Company available in the market (Aithal, 2016).

The threat of competitor rivalry

The company faces various attack of competitor through their new innovative strategies and high range of product, the competition will be analysed by evaluating the market shareholder and the by the estimating and comparing the company balance sheet and their income statement with the competitor statement it will clear all the picture and convey the company about preparing their next step to be that impactful as it gives tough competition to the competitor or rival.

Number of suppliers

The company have to analysis their existing supplier so that they can make a choice between them and also analyse the supplier cost and the value that will adjust the sufficient profit for the year. The company should choose their supplier by tasting their material quality and quantity they offer in the reasonable cost range.

Buying power of customer

The company should make sure the buying power of the customer. Especially the company will make such a decision and considered these point if they thinking about expanding their market in the new region or originating new product. The company should analyse the customer demographically as well as by estimating existing customer.

The threat of new entry

Aristocratic leisure limited company should analyse the new entrant that can destroy their market. The company should focus on learning about new entrants keep analyse the market. So that they will easily save them from this kind of threat.

Hence are some analysis that may help aristocratic leisure company to analyse the market and make adjustment and changes according to the result they will gather after evaluating and formulating the above criteria and then make strategies according to it and focus on the threat areas that they will suffer if they will not take any initiative to take certain decision and policies to become stronger in the market and lead the country (Kabue, & Kilika, 2016).

Discussion about any accounting adjustment

Aristocratic leisure company keep focused on the accomplishment of the desired objective. The accomplishment will be done through various stages.

The company need to make the various report and formulization to gather the cost efficiency, the finance manager engages in comparison process so that for the future they can make a plan with least cost and with high benefit.

The various accounting adjustment has to be made to know the exact issue and performance that is carried out by the company experts and professional.

The company processes ratio analysis to let know the current flow, liquidity in the company, return on equity and also gather the net profit margin that has been reached in the particular year.

The accounting adjustment that the company essentially required to gather the equity information so that they can distribute the dividend effectively.

Another accounting adjustment that must be considered while preparing ratios is to make sure assets and liabilities are correctly calculated and all the information is reliable and valid till that year respect. So that they will cover all the ratios effectively and correctly and with valid transparency.

Hence, these are some accounting adjustment that should be considered by Aristocratic leisure limited company while comparing, calculating, classifying or while summarizing all the data that is gathered for the particular year or the particular period.

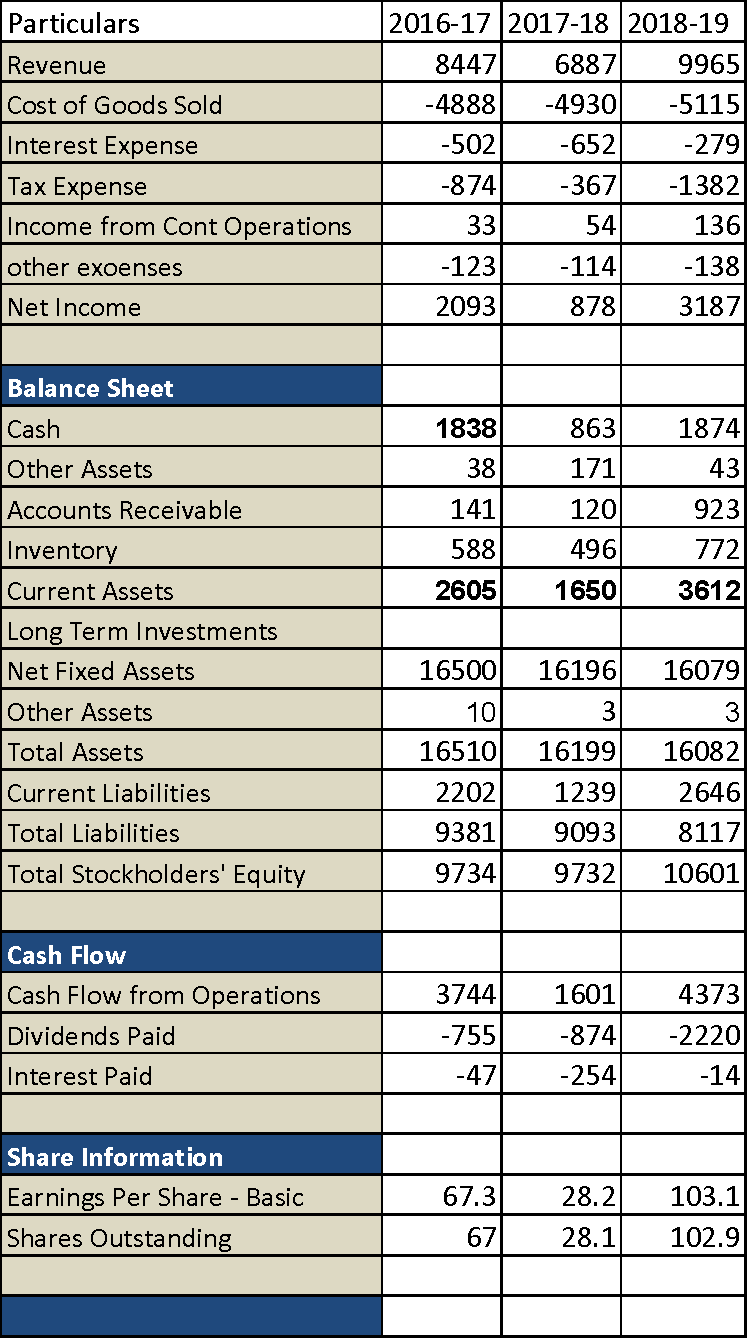

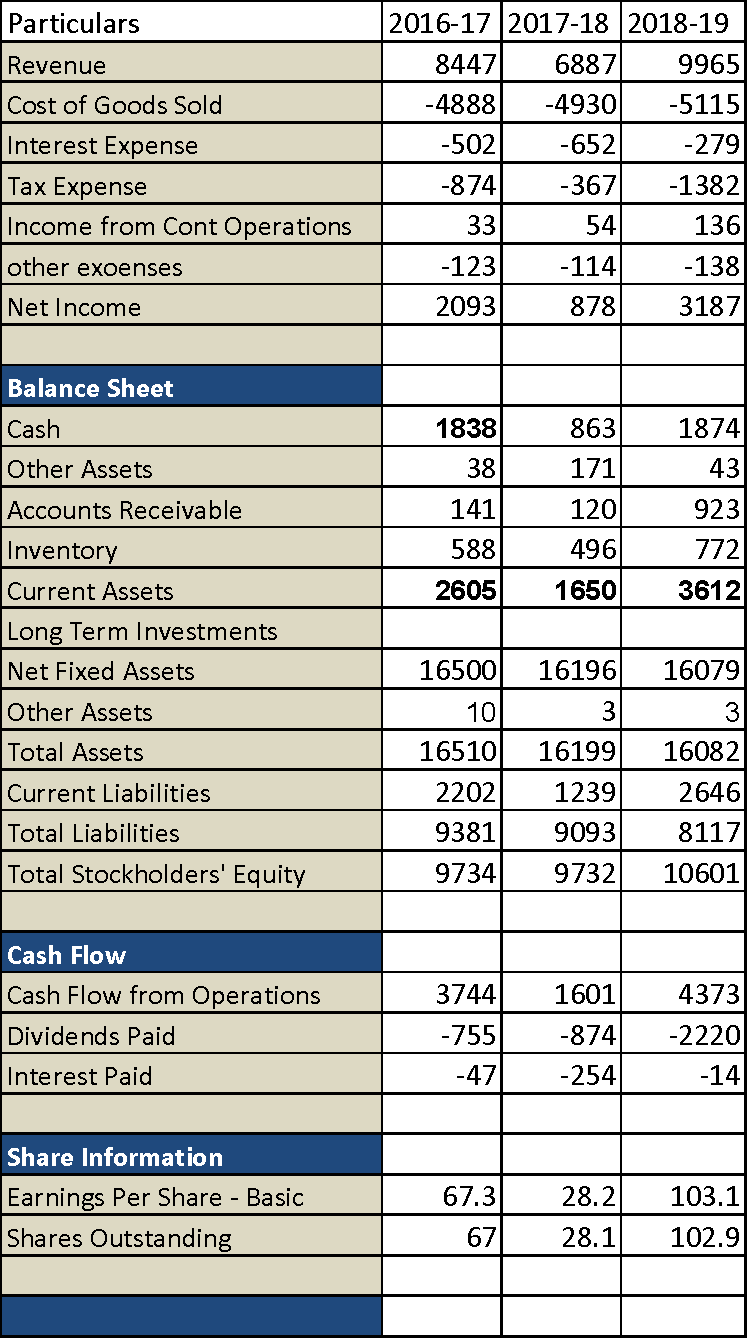

| Income statement for the three year |

| Particular |

2016-17 |

2017-18 |

2018-19 |

| revenue |

$2,128.70 |

$2,454 |

$3,549.80 |

| less: cost of revenue |

($872.70) |

($967.60) |

($1,577.50) |

| gross profit |

$3,001.40 |

$3,421.40 |

$5,127.30 |

| OTHER INCOME |

11.6 |

10 |

13.5 |

| Design and development cost |

($239.20) |

($268.40) |

($413.60) |

| sales and marketing cost |

($119.50) |

($116.80) |

($181.30) |

| general and administrative cost |

($301.50) |

($302.20) |

($512.50) |

| finance cost |

($100.20) |

($62.70) |

($115.30) |

| profit before income tax expenses |

($748.80) |

($740.10) |

($1,209.20) |

| income tax expenses |

($156.70) |

($233.00) |

($220.50) |

| net profit after income tax |

($592.10) |

($507.10) |

($988.70) |

| Balance sheet for the three year |

| Particulars |

2016-17 |

2017-18 |

2018-19 |

| Contributed Equity |

$693.80 |

$715.10 |

$715.10 |

| Reserves |

-$55.70 |

-$116.80 |

-$23.50 |

| Retained earnings |

$437.40 |

$747.30 |

$1,040.90 |

| Total Equity |

$1,075.50 |

$1,345.60 |

$1,732.50 |

| Cash and Cash Equivalent |

$283.20 |

$547.10 |

$428.10 |

| Other Current Assets |

$591.90 |

$647.90 |

$924.00 |

| Property, Plant and Equipment |

$217.50 |

$241.30 |

$389.30 |

| Intangible Assets |

$1,736.50 |

$1,687.70 |

$3,898.80 |

| Other non-current assets |

$158.60 |

$168.90 |

$206.60 |

| Total Assets |

$2,987.70 |

$3,292.90 |

$5,846.80 |

| Current Payables and other liabilities |

$434.90 |

$460.00 |

$821.10 |

| Current borrowings |

|

$0.10 |

|

| Current tax liabilities and provisions |

$114.30 |

$193.00 |

$196.40 |

| Non-current borrowings |

$1,287.80 |

$1,199.30 |

$2,881.10 |

| Non-current provisions |

$13.40 |

$13.80 |

$13.80 |

| Other non-current liabilities |

$61.80 |

$81.10 |

$201.90 |

| Total liabilities |

$1,912.20 |

$1,947.30 |

$4,114.30 |

| Net assets |

$1,075.50 |

$1,345.60 |

$1,732.50 |

| Cash flow statement |

|

|

|

| Particulars |

2016-2017 |

2017-2018 |

2018-2019 |

| Net cash flow from operating activity |

$680.50 |

$799.10 |

$933.80 |

| Net cash flow from investing activity |

-$209.30 |

-$236.50 |

-$2,207.60 |

| Net cash inflow from financing activity |

-$506.40 |

-$296.60 |

$1,135.20 |

| DuPont analysis |

| Sino. |

|

Particular |

2016-17$ |

|

2017-18$ |

|

2018-19$ |

|

| 1 |

net profit margin |

Net Profit Before Tax |

$507.20 |

0.238267487 |

$728.10 |

0.296723449 |

$867.60 |

0.239397368 |

| |

|

Sales |

$ 2,128.70 |

|

$2,453.80 |

|

$3,624.10 |

|

| |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

| 2 |

Assets turnover |

Sales |

$2,128.70 |

0.712487867 |

$2,453.80 |

0.745179022 |

$3,624.10 |

0.619843333 |

| |

|

Total assets |

$2,987.70 |

|

$3,292.90 |

|

$5,846.80 |

|

| |

|

|

|

|

|

|

|

|

| 3 |

Financial leverage |

total assets |

$2,987.70 |

2.777963738 |

$3,292.90 |

$2.45 |

$5,846.80 |

$3.37 |

| |

|

total equity |

$1,075.50 |

|

$1,345.60 |

|

1,732.50 |

|

| |

|

|

|

|

|

|

|

|

| |

DuPont analysis |

net profit margin*asset turnover *financial leverage |

|

|

|

|

|

|

| |

|

2016-2017$ |

0.471594607 |

|

|

|

|

|

| |

|

2017-2018$ |

$0.54 |

|

|

|

|

|

| |

|

2018-2019$ |

$0.50 |

|

|

|

|

|

| value of firm = market value of common equity + market value of preferred equity + market value of debt + minority interest-cash and cash investments |

|

| value of equity = share price * shares outstanding |

|

| value of firm |

3168.1 |

| value of equity |

$54,781.65 |

|

|

| share price |

$31.62 |

Justification of Assumption

If Aristocratic Company follows the entire relevant element while studying and analysing the market they will gain growth in the market.

If the aristocratic company should focus on analysing new entrant, as it reflects the knowledge with regards to new company their product specialization and their impact on the company share.

The company will also do these analyses to distinct their market from the competitor market.

The company will also know their customer belief and trust factor for knowing the customer value towards the company.

Hence these are some assumption that leads to make changes in the company and result in the accomplishment of the objective, mission and vision of the company. Thus this will lead to the growth of the company.

The firm is earning a net profit in the year is $3.62bn as compare to the year 2017 it is higher that is $2.62bn that reflect that the company successfully maintained their revenue every year and stabilize the firm growth by implementing best strategies and gaining sufficient amount of output.

Hence it clears that Aristocratic leisure limited company keep doing business strategies analysis to keep sustain in the market by increasing in their revenue with increment to the shares in the market (William & Dobelman, 2017).

Comparison of the firm growth rate through comparison between the preceding three years profit and loss account:

In 2018 the company is earning higher profit as compared to their previous year net profit that is $867m.it showcase that the company is in the stable and following growth rate formulae to accomplish the objective to become the market as well as a global leader.

In comparison with the balance sheet of the company is well organized as compared to the previous year as it contains more positive balance than a negative balance.

The company performance is also improved as compared to previous performance scale.

The company revenue also increases as compared to previous year revenue that is $3624.1 that is in 2017is $2453.8 that showcase the massive hike in the current revenue.

The company cash flow statement is reflecting better result as compare to previous year cash flow statement.

Hence if the company lookout overall change it is favourable and great changes that occur during this year and the company also holds the opportunity to give a higher dividend to their shareholder and their partners. Aristocratic Leisure Company is enjoying immense growth rates and that will engage them to think upon to formulate better prospectus and plan to enjoy that sustainability again (Schroeder, et.al., 2019).

Company future pre-assumption regarding their growth rate

Aristocratic leisure limited company keeps focusing on becoming the market as well as a global gaming company that provides a variety of gaming system all over the world and the company basic vision is to expand its business globally.

The adjustment is being made to keep the objective in mind. Aristocratic leisure limited company keep changes their product ranges and keep producing the latest and upgraded games with the digital format as well as real word format too.

The keep adheres to design best and innovative game ranges with attractive packing and with the exciting format of the games. The technical team of aristocratic leisure limited company keep indulging themselves in achieving the desired objective by building the best version of their next gaming ranges. so that this will help the company to set up the product into a new market with an existing position as this will helps to grab market penetration and further, it will result in increasing the product sales and automatically will result in gaining high amount of profit.

The benefit of this entire will later share with their shareholder and this will increase the trust of the shareholders on the company and encourage them to put more investment and proposed more proposals and give the chance to take the opportunity to initiate the same.

Hence Aristocratic company focuses on sustainability in the position and development in the gaming system with fastest and innovative gaming product and to have customer belief and trust with affordable pricing with before earning sufficient amount of profit and also to increase the market value of the company (Stindt, et.al.,2017).

Conclusion about the value of the firm and value of equity