Introduction

Innovation is very necessary for any organisation. There are various current trends in any type of industry. Trend changes according to time. Therefore it is necessary to implement the change in the product. This can be helpful with the help of new ideas and innovation. Ideas are implemented for making the product better than the present condition of a particular product. Various problems regarding the products can be solved with the help of innovation (Björkdahl & Holmén, 2013). The productivity of the product can be enhanced with the help of innovation. Apple is having very innovative products. Innovation in the products of Apple results in a large number of sale. This assessment analyses the innovation of Apple. This report provides information that innovation is helpful in making a good offering to reach a large number of customers. Resources can be organised well with the help of innovation in the business.

Types of Innovation – Radical and incremental innovation in smartphone industry

All the devices that are made by smartphone companies are user-friendly. It is not the situation in which users are having trouble of using the devices. The connection of humanness is bringing by smartphones with the technology in the products. This strategy attracts a large number of customer towards this industry. This leads to growth and research on further innovation. It is the thinking of companies that they are designing a product for the human fingers and hands. Smartphone companies are designing their products for the humans not for the code Jockeys (Innovarsity.com, 2018.

Internet connectivity also played a great role in bringing the innovation in this industry. The art and the design in the product attract the customer. The design of the product is inspired by humanity. The human values are embedded in the products in the present smartphones. The product of present companies is the intersection of Science and humanity (Heracleous, 2013).

Radical innovation

It is the type of innovation that has never been experienced by customers. The acceptance of these type of innovations takes time to be accepted in the market. In the smartphone industry, the radical innovations by apple are: –

Formulation of offerings

According to Gershon (2013), Apple is one of the leading Smartphone, laptop and computer manufacturing organisation. This company also manufactures accessories of smartphone, laptop and computers. This organisation is one of the leaders in innovation in the world. This organisation provides unique features in its product. The uniqueness of the product results in innovation. The unique combination of great software involved in hardware results in large customer base for this organisation. Apple is having the ability to create new business species Björkdahl, J. and Holmén, M., 2013that helps in the creation of New Market Niche. Most popular products of Apple are iPhone, MacBook, iTunes, iPod and iPod. These are the products that show the great innovation in offering a product to the customer. The innovation is bringing in the Apple according to Vision and Mission of the organisation. The organisational structure of Apple matches with firm strategy.

Beauty in product

The engineering to the product of this company is accomplished so that beauty in the products can be implemented. The products are designed in such a way that they are good at Eyes. It was the belief of Steve Jobs that human being never holds ugly things in their hand. With this belief beauty in design was brought by Apple.

Incremental innovation

These are the type of innovations that are developed which are already present in the market and experienced by the customers. These innovations are developed in smartphone industry by Apple as: –

Innovative partnerships

Apple creates opportunity in the market for its partner to get a large number of profits. This opportunity can be created by Apple because of innovation. Every new product of Apple is having new innovation (Cheng, et. al., 2014). New innovation creates a difference in the market. This brings the customer to the Apple Store.

Supply chain

Apple over-invest in the supply chain management. Apple has a tendency to launch its product with the new innovation. It is the trend in the market that after the launching of the product, it gets popularised. This can result in a shortage of the product in the market.

4ps model of exploring innovation

Paradigm

Apple manufacturer’s smartphones like iPhone and also manufacturer’s iPod. These products will never be successful if there will be no App Store and iTunes. This is the innovation strategy that is followed by Apple. The app store is the smartphone application store licensed only for Apple products. Apple user can download any of the smartphone apps from App Store. Most of the Smartphone manufacturers are not having their own operating system. They purchase the licence of Play Store for smartphone applications.

Product

The employees of this organisation do face to face discussion regarding the product and its offerings that is made by the company. There can be another way like instant messaging and teleconferencing that can be used for discussing regarding the product. Apple always focuses on creating the product such that positive review can be circulated in media. Apple takes help from an influencer. This company believes in face to face analysis about the product among the employees of the organisation. The opinion can be made by any employee of the organisation regarding the correct (Lehman & Haslam, 2013). This is helpful in making the product very useful for the customer. Various problems and issues regarding the product can be analysed with the help of this discussion. The endless test is conducted by Apple before launching the product in the market. The product is offered to the customer full of analysis. The collaboration is bringing by apple for the promotion of innovation in the product.

Process

The resources of Apple can be managed well with the help of innovation. Apple is having most high price product in the market even then there are higher sales of Apple product in the market. This is because Apple places its product with unique values in the market. This helps in value creation and branding of this organisation. App stores are having innovative apps that are helpful in creating a success story for the products of Apple. A user can easily download the applications from the App Store and use them for their utility (Shuler, et. al., 2012). iPhone get its platform in the world market because of App Store. The strong business model for Apple is because of Association of product with the software and other technology that is also made by Apple. iTunes is used in Smartphone as well as iPods. iTunes is a media player from which online music can be played. iTunes launched on 9th of January 2001. It can be operated in Mac OS. Mac OS is the graphical operating system that is developed by Apple for its product.

There is no permission required for Apple products while using app store and iTunes. Products and the software both are developed by Apple. These are the main resources of Apple hands can be easily managed as developed and operated by Apple only. This business model is creating a large amount of profit for Apple. The applications present in the app store are user-friendly and authenticated. There are very less chance of malware entering in the Smartphone and laptop application of Apple. This creates trust among the customer. This is the milestone example of innovation that is managing its software as well as hardware resources (Innovarsity.com, 2018).

Position

Apple is blessed with employees like Steve Jobs. Innovation is promoted by Steve Jobs in this organisation (Kapoor & Agarwal, 2017). With the help of innovative process the customers can be targeted by the apple at different places like in the seminar, public gatherings. The online advertisements and the TV commercials are also the good tools of targeting the people by Apple. Innovative ideas were welcomed from any of the employees of Apple at the time of Steve Jobs as well as the present by which targeting of the customers can be possible.

Sources of Innovation

Partnership

Apple stores are operated by the franchise of Apple. The growth in the business of Apple results in the growth of partners also. With the help of innovation, partners can be managed as they are also interested in future business with Apple. Therefore it is an innovative strategy that is implemented by Apple for its partner.

Distribution

For no shortage in the market Apple over-invest in the supply chain. Products of Apple are easily available in the market because of innovative supply chain strategy. The demand for pre analysed of the products of Apple. According to the demand-supply of the products are accomplished (Wijaya, 2013).

Nurturing talent among employees

Employees of this organisation help each other in the critical situation regarding Technology. This helps in the development of the technology at Apple. With the help of this coordination, Apple is easily able to manage their staff. When Steve Jobs was the CEO of Apple he always nurtures his employees to take their talent out for the products. The motivation strategy is always followed by since or for the employees of Apple.

HR as executive

The HR department of Apple is treated as an executive department. All the risk that is associated with apple is provided by the HR department of this organisation. Constructive measures that can be taken for mitigating the risk are also provided by the HR department. Effective communication is managed between the employees by this department so that coordination among the employees can be increased (Ngo & O’cass, 2013). This results in effective innovation for the organisation. The human resource of this organisation designed an innovative system. the creativity can be harness among the employees because of the innovative system used by this organisation (Khan, et. al., 2015).

Push and pull influence innovation in Apple

Reaching to customers as push factor

Apple talks to their customer in their language. This helps the customer to feel close to the Apple. This is the strategy that is implemented by Apple attracts a large number of customer. This provides a better customer experience with the customers of Apple. The advertisement for Apple products are made that prospects emotions. The emotion of the common man is in the advertisement of Apple products (Apple, 2018). This creates a sense of belonging among the customers. Influencer is helpful in targeting the relevant audience regarding the products of Apple. The marketing that is accomplished by this organisation is done with the product story. The marketing is done in a simple way that is easily understood by any customer (Apple, 2018). This simplicity helps in targeting the customer easily.

Venture acquisition as pull factor for innovation

The steps are taken as pull factor by the Apple is venture acquisition. The innovation can be bringing in the organisation that will easily attracts the customers. Apple purchased many of the organisations for organising resources and creating innovation. In 1998 network innovation was purchased by Apple. This helps the Apple to get Intel processor in their product. In 1998 Macromedia’s intellectual property was acquired by Apple. At the same time employee team that developed video editing program was also acquired by Apple to establish itself in the video editing market.

The 2005 acquisition with Finger Works helps this organisation in the touch technology by acquiring this company various patents was also acquired by Apple that is used in the iPhone and iPad. The digital advertisement Campaign of the Apple is fulfilled by acquiring the Quattro wireless in 2010. The advertisement in the mobile device can be possible with the help of this organisation. This helps the apple in fulfilling the advertisement strategy. The software application market is based on advertisement and their utility (Innovarsity.com, 2018).

Venture acquisition help in managing the present innovation of Apple. A new innovation in this organisation is also created because of venture acquisition. This new innovation can be managed by that organisation from which acquisition is done by Apple. In this way, various resources that are necessary to develop for Apple can be possible with an acquisition. An acquisition is also creating sustainability for apple. The acquisition helps in the development of new products with effective management of the resources that are needed in developing those products. This development is possible with the help of acquisition only.

Conclusion

Innovation is very necessary for any organisation. Innovation brings new ideas and technologies in the organisation. Innovation also helps in facilitating the business of organisations like apple. With the help of innovative offerings can be made to the customer easily. The method of reaching to the customers can be made simple with the help of innovation. Easy management of the organisational resources can be possible with the help of innovation. Innovation is helpful in creating business growth. This business growth provides a good amount of profits to Apple. The value added to the business can be created with the help of innovation.

References

Apple. 2018. Marketing Resources and Identity Guidelines [Online]. innovarsity.com. Available at: https://developer.apple.com/app-store/marketing/guidelines/. [Accessed: 4 December 2018].

Björkdahl, J. and Holmén, M., 2013. Business model innovation–the challenges ahead. International Journal of Product Development, 18(3/4), pp.213-225.

Cheng, C.C., Yang, C.L. and Sheu, C., 2014. The link between eco-innovation and business performance: a Taiwanese industry context. Journal of Cleaner Production, 64, pp.81-90.

Gershon, R.A., 2013. Digital media innovation and the Apple iPad: Three perspectives on the future of computer tablets and news delivery. Journal of Media Business Studies, 10(1), pp.41-61.

Heracleous, L., 2013. Quantum strategy at apple inc. Organizational Dynamics, 42(2), pp.92-99.

innovarsity.com. 2018. Apple’s Systemic Approach To Innovation. [Online] innovarsity.com. Available at: http://www.innovarsity.com/coach/bp_innovation_strategies_apple.html. [Accessed: 4 December 2018].

Kapoor, R. and Agarwal, S., 2017. Sustaining superior performance in business ecosystems: Evidence from application software developers in the iOS and Android smartphone ecosystems. Organization Science, 28(3), pp.531-551.

Khan, U.A., Alam, M.N. and Alam, S., 2015. A critical analysis of the internal and external environment of Apple Inc. International Journal of Economics, Commerce and Management, 3(6), pp.955-961.

Lehman, G. and Haslam, C., 2013, December. Accounting for the Apple Inc business model: Corporate value capture and dysfunctional economic and social consequences. In Accounting forum (Vol. 37, No. 4, pp. 245-248). Elsevier.

Ngo, L.V. and O’cass, A., 2013. Innovation and business success: The mediating role of customer participation. Journal of Business research, 66(8), pp.1134-1142.

Shuler, C., Levine, Z. and Ree, J., 2012. iLearn II An analysis of the education category of Apple’s app store.

Wijaya, I.M., 2013. The influence of brand image, brand personality and brand awareness on consumer purchase intention of Apple smartphone. Journal EMBA: Jurnal Riset Ekonomi, Manajemen, Bisnis dan Akuntansi, 1(4).

Executive summary

In this assessment measurement of performance for the Samsung is accomplished. The strategies that are involved in the performance management by the Samsung are also analysed. The stakeholders are the main entity of any organisation. The methods that are involved by the Samsung for the management of risk associated with this organisation are also determined in this assessment. The financial performance that is accomplished by this organisation is described in this assessment. The perception of the customers regarding the performance of Samsung is also presented in this assessment. The recommendations that are necessary for the improvement of performance are investigated in this assessment.

Introduction

Performance management is a whole new aspect which starts as soon as an employee enters the organization and ends with the resignation of the employee. Performance management facilitates communication with its employee and helps the organization in measuring the performance of the employee and appraising the employee. Samsung manages the performance of its employee and provides them with incentives to them motivated towards the work. Performance management not only includes the employee performance but also how the organization creates and maintains their stability in the market. How they manage their risk and communicate with their stakeholders. How they react to the feedback and perspective of customers and clients (Chow and Gender, 2015).

It also, makes sure that the operation of Samsung is running effectively and the evaluation and of the performance is done accurately. In the end, the deviations in the performance are analyzed and proper implementation towards it is made.

Organizational performance management and performance measurement

Samsung is a Korean based company offering services to its customers and job opportunity to its employees for 50 years approx. Samsung is the second largest information technology company in terms of revenue in the world. Samsung deals with electronic items like mobiles, laptops, television, refrigerators, etc. The organizational performance management system is the process of analyzing, evaluating and managing the performance of the organization throughout the year. By using the previous data and information, the performance of Samsung’s employee is measured so that the appraisal to the employee could be given. It helps in analyzing that whether the performance of the employee matches with the performance meters set for the employee, and if not, corrections to the policies are made (Grant, 2016).

(Figure: Performance management)

(Source: Grant, 2016)

Performance management is an art of creating an environment where the employees could work with their best of abilities. It focuses on evaluating the performance rate of the employees and helps in communicating with them. It starts when an employee enters an organization and continues until he left the organization. Performance management and performance measurement are related to each other. Samsung makes sure that its employee is working in a coordinated environment where their thoughts are always given a place and they are also motivated for their achievements so that they could give their best performances. Samsung uses the pricing strategy for its employee. Towards the best contribution, the employees are awarded and appraised. Many training and development programs are running in a year and the grievances of the employees are communicated so that they could feel the safe and important in the organization (Chadwick, et. al., 2015).

Performance management helps in the welfare of the employee and thus, develops the skills and standards of its employees. By motivating and waking their initiatives, Samsung could be able to gain effective performance of its employee and thus, the organization. Good performance results in optimum utilization of its resources and help in achieving its objectives effectively and efficiently and thus, helping Samsung, in establishing good brand value in the market.

Communicating performance to stakeholders

Communication is the most important aspect of any business. Samsung makes sure that it communicates with each stakeholder so that it could be able to build good relationships with them.

| Stakeholders |

Promotional schemes |

Communicating ways |

Expectations |

| Employees |

Samsung hires and cultivates talented and skilled people and provides them with adequate training and development throughout the year. It provides time to time performance appraisal to them and provides them with good incentives. |

Multidimensional evaluation,

VOE. |

The welfare of the employees, their development rate, appraisal, and fair compensation. |

| Shareholders |

Samsung understands the importance of its stakeholders and regularly communicates with them via shareholders meetings and minute maids. It helps the shareholders in knowing the issues and also the achievements of the organization, thus helping Samsung in establishing good relationships. |

IR activities,

Meetings of shareholders (Hatch, 2018). |

Cooperation with them, increasing the values of shareholders. |

| Customers |

Samsung values its customers and understands the fact that the customer is its ultimate aim. They aim at providing maximum satisfaction to its employees, by keeping regular communication procedure with its clients. It welcomes the feedback of its customers and always works on it. It treats the customer as part of its organization and adopts new schemes for providing benefits to its employees. |

CS surveys meetings, VOC. |

Increases customer satisfaction and support, aids on providing the protection to the privacy of its customers. |

| Government |

Samsung fulfills all the rules and regulations of the government and maintains healthy relationships with the central power. Through, seminar and conferences, it provides the performance o the company and keeps transparency with the government. It relays on the fact that, with the mutual relationship both the party could grow together. |

Seminars, conferences,

Magazines and newspaper supplies (Basole, 2016). |

Management of governable ethics, legal compliance. |

Risk management

From the recent reports and data, it could be seen that the customers are not satisfied with the performance of the Samsung. Many reports regarding the explosions of the phones have been seen. Hanging on the phone is the main and the most accepted problem in the Samsung products.

(Figure: Risk Management)

(Source – Fainshmidt, et. al., 2016)

Samsung should try to minimize it. Risk management helps the company in managing its risks and moving ahead. Risks directly aim at the downfall of the company. Risk management helps the company in identifying the risks in the company and helps the company in framing new laws and policies for the company so that it could be able to minimize it and rise in the market (Fainshmidt, et. al., 2016).

Quality management and improvement

Quality is something which should not be compromised. Samsung aims at providing quality products at reasonable rates. Samsung says that quality should never be ignored for quantity. By providing qualitative services to its customers, it provides satisfaction to its client and thus, increases its business. Quality management involves the activities where the quality of the product or service is measured and compared to its standards sets, if any deviations occur in that, new protocols are formed, and a better product is supplied (Gruber, et. al., 2015).

Samsung works on achieving excellent quality products so that it could outshine in the market. Samsung deals in electronics items and compromising the quality in this fields leads to the losses and no interest from the customer because of the competition in the market. To gain a successful business, Samsung makes sure that all its operations are qualitative and the work is going on effectively and efficiently.

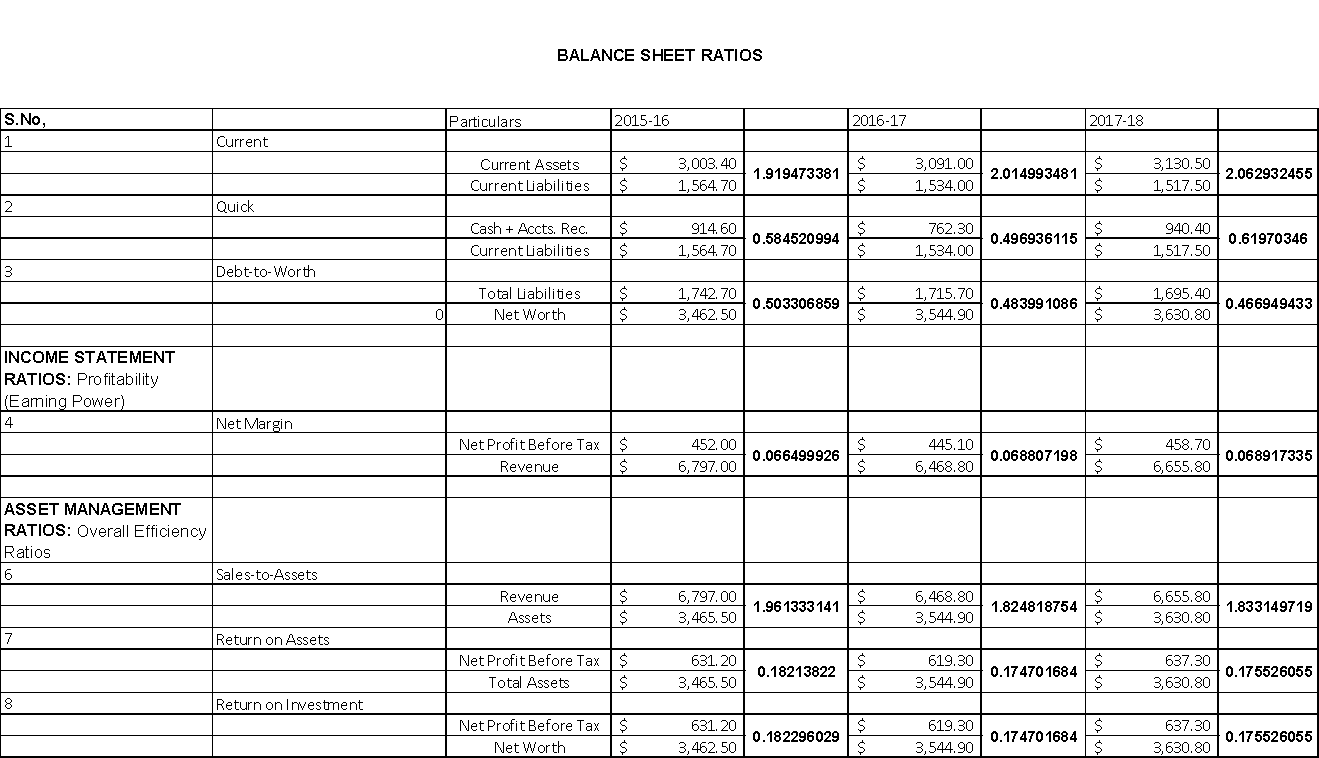

Financial performance

Samsung has stable financial resources and is the highest revenue earning company in the sector. It aims at quality products at affordable prices which helps in generating customers for the company and thus, helping in increasing revenues of the company. Samsung has achieved able financial goals and is capable of achieving them. Financial performance helps to measure and to maintain the policies and operation of the firm in a year. From the data and information, available it could be seen that revenue of Samsung is increasing year by year and is becoming the top competition for the well-established firms like Apple. In the past years, some of its products saw the downfall in the market, but overall Samsung is working for uplifting its company’s brand and is establishing an excellent track for achieving its financial objectives (Arora, et. al., 2015).

Customer and client perspective

The customer is the ultimate resources of the company. The company is made and ran for its customer. What a customer thinks about the company, matter a lot. Samsung makes sure that its brand image and identity is good in the market. It makes steps for analyzing that its customers are getting what it is conveyed to them and are not framing negative perspective about the company. It is important to maintain healthy relationships with the customers so that, the company could benefit through mouth advertisement. Having a positive mindset of the company, company frames new customers in the market and is able to provide satisfaction to its customers (Ramadan, et. al., 2017).

Samsung achieves mutual relationships with its clients by providing them with high-quality services through a number of channels, previously, customer centers were contacted only when, a problem arises, but now, a minute problem, customer call the call centers and figures out the solution. Samsung should aim at providing excellent customer care services to its customers and gain a positive image in the market.

People Perspective

What brand image a company is forming in the market tells a lot about the performance of the company.

Samsung’s objective is not limited to selling or promoting a product or fixing the product but also; it aims at establishing good relationships with its employees. By building interrelationships, Samsung caters at solving the problems of the customer and providing them with fuller satisfaction. Samsung also aims at providing doorstep services to its customers so that, they could not face problems of loading the products to the repair shops and bear the costs. By delivering amazing services, it helps the company in getting more investments in the wide range of its products by its customer and thus, creating huge profits for the company.

Samsung is well known for its quality products and also at reasonable prices and helps the company in generating new customers every year (Lin, 2017).

Samsung is not only customer oriented company but also focuses on the welfare of its employees. It provides time to time appraisal to its employee and creates good brand value in the market. By giving good incentives and recognition to the employees, the company is able to gain a positive perspective from the people and thus, it will be able to gain social approval.

Implementation issues

Samsung is growing day by day and is adopting new technological advancements in its products. With the fashionable mobile phone to smart television, it is taking over the market. As it is providing amazing products and service to the customer it is charging it from the customer for the same. But, customers face a lot of problems in the product of Samsung and especially in its mobile ranges (Cai, et. al., 2018).

Mobile comes with a handy feature and is now a replica of many activities. But Samsung is compromising in the quality of the product. Problems like battery poor life glitches like bad applications performance upset the customers who are paying the high prices for the same. A most common problem that is seen in the products of Samsung is mobile hanging and automated rebooting. It disturbs the tasks of the customers and impacts the performance of the overall company (Grant, 2016).

According to the technology, Samsung is adopting new advancements, but the portable charging mode is not up to the expectations which make customers, dissatisfied. This issue makes it hard for the company to maintain its performance and harms the image of the company too.

Recommendations for improvement

Although, the Samsung is doing good in the market, its Mobile and tablets range, is not working much in the market due to its bad performance and many other reports like an explosion of the handset and of course, the biggest problem hanging and the battery life of the mobile phone. As a result, decreasing market share of Samsung could be seen and also, dissatisfaction on the side of the customer could be observed.

For grading up the market share and providing the satisfaction to the customer, following are the recommendations on which Samsung could act upon:

- Improve battery life: Mobile runs in the battery and if the battery is not sufficient then, the problems will arise gradually. The customer now a day’s do not use the phone only for calling or text but also for several other activities which demand the fuller battery performance of the model. Samsung should focus on increasing the battery effectiveness of the product so that customer could be kept loyal to the company (Hatch, 2018).

- Cutting down on new ranges of the particular product or cutting back on models: Samsung has this habit of releasing a new phone with advance feature every now and then, which upsets the customer as its possession seems to be outdated and newer one seems to be updated which makes the customer worried about the cost and performance. New and updated products symbolize the social status and market value of the customer and the outdated one declines it.

- Explosions of the phone should be treated: Customers face a huge problem of explosion due to heating up of the mobile phone. A mobile phone completes works or operates on the software and hardware of the product and the heating up of mobile hardware’s results in the heating and blasting up of phones. Samsung should aim at the development of good quality software having excellent performance and its heating and blasting problem should also be fixed (Budhraja, et. al., 2017).

- Improvement in the software: Samsung should focus on gaining the advantage from its competitors. Samsung’s software is having this problem of hanging and rebooting and which needs to be fixed. Investments on the newer feature introduction in the phone should be focused so that the newer customers could be attracted.

Conclusion

From the above report, it could be concluded that the measurement of the performance of the organization and the employee is necessary for an organization. Performance management helps the organization in knowing their performance throughout the year and also, helps in knowing where the deviations are and where the corrections are needed. It helps the companies in managing risks and other uncertainties. It facilitates the communication gap between the employees and its stakeholders. It helps the company in appraising the performance of its employees and helps in taking many other decisions regarding the value and their feedback of the people. It helps in establishing interaction between the providers and customers and facilitates the facility of quick feedback. Most importantly, performance management not only measures and manages the performance but also helps in improving the quality of the performance of both employee and organization.

References

Arora, A., Arora, A.S. and Sivakumar, K., 2016. Relationships among supply chain strategies, organizational performance, and technological and market turbulences. The International Journal of Logistics Management, 27(1), pp.206-232.

Basole, R.C., 2016. Topological analysis and visualization of interfirm collaboration networks in the electronics industry. Decision Support Systems, 83, pp.22-31.

Budhraja, V.S., Dyer, J.D. and Morales, C.A.M., Electric Power Group LLC, 2017. Real-time performance monitoring and management system. U.S. Patent 7,233,843.

Cai, J., Liu, X., Xiao, Z. and Liu, J., 2018. Improving supply chain performance management: A systematic approach to analyzing iterative KPI accomplishment. Decision support systems, 46(2), pp.512-521.

Chadwick, C., Super, J.F. and Kwon, K., 2015. Resource orchestration in practice: CEO emphasis on SHRM, commitment‐based HR systems, and firm performance. Strategic Management Journal, 36(3), pp.360-376.

Chow, J. and Gender, T.K., Honeywell International Inc, 2015. Flash memory management system and method utilizing multiple block list windows. U.S. Patent 6,895,464.

Fainshmidt, S., Pezeshkan, A., Lance Frazier, M., Nair, A. and Markowski, E., 2016. Dynamic capabilities and organizational performance: A meta‐analytic evaluation and extension. Journal of Management Studies, 53(8), pp.1348-1380.

Grant, R.M., 2016. Contemporary strategy analysis: Text and cases edition. John Wiley & Sons.

Gruber, M., De Leon, N., George, G. and Thompson, P., 2015. Managing by design.

Hatch, M.J., 2018. Organization theory: Modern, symbolic, and postmodern perspectives. Oxford university press.

Lin, C.S., 2017. Untangling the relationship between strategic consistency and organizational performance: An empirical analysis of moderator variables. Journal of Management & Organization, 23(4), pp.483-503.

Ramadan, B.M., Dahiyat, S.E., Bontis, N. and Al-Dalahmeh, M.A., 2017. Intellectual capital, knowledge management and social capital within the ICT sector in Jordan. Journal of Intellectual Capital, 18(2), pp.437-462.

| Property Id |

Market Price ($000) |

Sydney price Index |

Total number of square meters |

Age of house (years) |

| 1 |

971 |

95.4 |

348.2 |

2 |

| 2 |

971 |

90.0 |

336.1 |

3 |

| 3 |

966 |

97.9 |

335.0 |

9 |

| 4 |

965 |

135.7 |

328.2 |

10 |

| 5 |

964 |

121.1 |

316.8 |

14 |

| 6 |

958 |

136.7 |

309.1 |

12 |

| 7 |

955 |

141.3 |

308.9 |

8 |

| 8 |

952 |

89.8 |

307.7 |

14 |

| 9 |

948 |

183.9 |

306.8 |

13 |

| 10 |

944 |

94.6 |

300.4 |

6 |

| 11 |

932 |

96.7 |

299.2 |

5 |

| 12 |

931 |

90.1 |

295.7 |

8 |

| 13 |

925 |

65.5 |

293.0 |

7 |

| 14 |

921 |

147.3 |

292.7 |

7 |

| 15 |

920 |

122.2 |

292.5 |

10 |

| 16 |

917 |

183.0 |

292.0 |

4 |

| 17 |

915 |

120.9 |

291.3 |

11 |

| 18 |

913 |

70.8 |

289.8 |

9 |

| 19 |

912 |

144.0 |

287.8 |

4 |

| 20 |

908 |

108.7 |

281.9 |

11 |

| 21 |

905 |

125.6 |

281.1 |

7 |

| 22 |

902 |

76.5 |

280.4 |

8 |

| 23 |

893 |

110.6 |

280.1 |

7 |

| 24 |

893 |

91.8 |

277.5 |

12 |

| 25 |

885 |

116.5 |

277.3 |

6 |

| 26 |

885 |

104.1 |

277.3 |

15 |

| 27 |

885 |

124.1 |

275.0 |

14 |

| 28 |

884 |

147.1 |

274.4 |

10 |

| 29 |

883 |

75.8 |

274.1 |

13 |

| 30 |

879 |

106.3 |

274.1 |

12 |

| 31 |

879 |

97.3 |

273.9 |

19 |

| 32 |

879 |

86.8 |

273.0 |

6 |

| 33 |

878 |

54.6 |

272.5 |

9 |

| 34 |

878 |

93.1 |

272.3 |

9 |

| 35 |

877 |

133.9 |

272.0 |

9 |

| 36 |

877 |

118.0 |

272.0 |

13 |

| 37 |

877 |

155.7 |

271.4 |

1 |

| 38 |

875 |

83.2 |

271.4 |

19 |

| 39 |

875 |

129.0 |

271.4 |

18 |

| 40 |

874 |

77.5 |

269.5 |

11 |

| 41 |

874 |

96.3 |

269.4 |

17 |

| 42 |

874 |

94.8 |

269.1 |

17 |

| 43 |

873 |

87.5 |

268.7 |

12 |

| 44 |

872 |

122.5 |

267.7 |

4 |

| 45 |

871 |

130.7 |

267.0 |

8 |

| 46 |

866 |

104.9 |

266.4 |

12 |

| 47 |

865 |

143.6 |

266.4 |

10 |

| 48 |

865 |

93.7 |

265.6 |

11 |

| 49 |

863 |

133.3 |

265.0 |

14 |

| 50 |

863 |

156.8 |

262.0 |

16 |

| 51 |

863 |

63.2 |

259.2 |

11 |

| 52 |

863 |

84.9 |

258.7 |

22 |

| 53 |

863 |

113.3 |

258.7 |

18 |

| 54 |

862 |

118.3 |

256.8 |

12 |

| 55 |

862 |

77.1 |

256.4 |

17 |

| 56 |

862 |

137.6 |

254.5 |

3 |

| 57 |

861 |

85.4 |

253.3 |

22 |

| 58 |

860 |

132.5 |

253.3 |

10 |

| 59 |

859 |

123.0 |

253.2 |

19 |

| 60 |

859 |

82.3 |

252.5 |

22 |

| 61 |

858 |

87.2 |

252.5 |

16 |

| 62 |

856 |

115.0 |

251.9 |

10 |

| 63 |

856 |

111.8 |

251.8 |

37 |

| 64 |

855 |

131.3 |

251.4 |

21 |

| 65 |

853 |

171.6 |

250.5 |

24 |

| 66 |

852 |

61.8 |

250.2 |

38 |

| 67 |

849 |

135.5 |

249.7 |

31 |

| 68 |

847 |

149.8 |

248.2 |

4 |

| 69 |

846 |

132.5 |

248.1 |

35 |

| 70 |

846 |

64.4 |

248.0 |

10 |

| 71 |

846 |

69.8 |

247.8 |

34 |

| 72 |

846 |

101.7 |

246.4 |

29 |

| 73 |

845 |

71.8 |

245.9 |

31 |

| 74 |

845 |

132.7 |

245.2 |

3 |

| 75 |

845 |

89.7 |

244.8 |

13 |

| 76 |

844 |

141.1 |

244.8 |

40 |

| 77 |

843 |

123.5 |

244.2 |

33 |

| 78 |

843 |

73.4 |

243.6 |

27 |

| 79 |

842 |

84.9 |

242.9 |

10 |

| 80 |

842 |

113.4 |

242.9 |

39 |

| 81 |

842 |

70.6 |

242.5 |

14 |

| 82 |

841 |

101.5 |

242.3 |

19 |

| 83 |

840 |

66.6 |

242.3 |

12 |

| 84 |

839 |

142.2 |

242.0 |

25 |

| 85 |

839 |

117.6 |

241.6 |

19 |

| 86 |

839 |

94.1 |

241.6 |

25 |

| 87 |

839 |

171.0 |

241.1 |

34 |

| 88 |

838 |

78.0 |

241.0 |

17 |

| 89 |

838 |

124.3 |

240.4 |

25 |

| 90 |

838 |

82.9 |

239.6 |

5 |

| 91 |

837 |

85.3 |

239.4 |

30 |

| 92 |

837 |

136.3 |

239.2 |

22 |

| 93 |

836 |

110.3 |

239.2 |

3 |

| 94 |

836 |

85.3 |

238.9 |

2 |

| 95 |

835 |

137.4 |

238.7 |

24 |

| 96 |

835 |

90.9 |

238.6 |

34 |

| 97 |

835 |

79.6 |

238.5 |

15 |

| 98 |

834 |

79.8 |

237.3 |

53 |

| 99 |

834 |

67.1 |

236.9 |

30 |

| 100 |

834 |

153.1 |

236.7 |

16 |

| 101 |

833 |

79.3 |

236.0 |

23 |

| 102 |

833 |

111.5 |

235.8 |

34 |

| 103 |

833 |

133.5 |

235.2 |

12 |

| 104 |

832 |

139.9 |

235.0 |

18 |

| 105 |

832 |

93.2 |

235.0 |

1 |

| 106 |

832 |

117.6 |

234.9 |

13 |

| 107 |

831 |

98.0 |

234.6 |

24 |

| 108 |

831 |

94.0 |

234.4 |

10 |

| 109 |

831 |

92.1 |

234.4 |

22 |

| 110 |

830 |

65.5 |

234.4 |

5 |

| 111 |

829 |

84.2 |

234.4 |

40 |

| 112 |

829 |

113.8 |

234.3 |

28 |

| 113 |

828 |

91.2 |

234.2 |

32 |

| 114 |

828 |

148.4 |

233.9 |

6 |

| 115 |

827 |

99.0 |

233.8 |

28 |

| 116 |

827 |

112.9 |

233.8 |

15 |

| 117 |

827 |

99.8 |

233.0 |

4 |

| 118 |

827 |

69.8 |

232.6 |

10 |

| 119 |

826 |

107.1 |

232.5 |

8 |

| 120 |

825 |

90.8 |

232.4 |

12 |

| 121 |

824 |

92.2 |

232.2 |

1 |

| 122 |

823 |

136.3 |

231.8 |

24 |

| 123 |

823 |

126.4 |

231.7 |

15 |

| 124 |

822 |

87.4 |

231.2 |

1 |

| 125 |

822 |

90.3 |

231.2 |

6 |

| 126 |

822 |

90.8 |

231.0 |

45 |

| 127 |

822 |

168.1 |

230.5 |

44 |

| 128 |

820 |

110.8 |

230.3 |

3 |

| 129 |

819 |

131.7 |

230.0 |

1 |

| 130 |

819 |

112.3 |

229.6 |

9 |

| 131 |

818 |

134.1 |

229.3 |

7 |

| 132 |

817 |

105.6 |

229.0 |

38 |

| 133 |

816 |

130.9 |

228.6 |

15 |

| 134 |

815 |

60.6 |

228.5 |

1 |

| 135 |

815 |

131.0 |

228.1 |

31 |

| 136 |

815 |

78.9 |

228.0 |

32 |

| 137 |

814 |

109.1 |

227.7 |

10 |

| 138 |

812 |

81.6 |

227.5 |

24 |

| 139 |

812 |

47.1 |

227.5 |

29 |

| 140 |

811 |

125.0 |

226.8 |

20 |

| 141 |

810 |

85.6 |

226.7 |

19 |

| 142 |

810 |

104.5 |

226.3 |

19 |

| 143 |

810 |

160.8 |

226.0 |

46 |

| 144 |

810 |

124.2 |

225.6 |

19 |

| 145 |

809 |

115.1 |

225.5 |

26 |

| 146 |

808 |

126.9 |

225.5 |

18 |

| 147 |

807 |

80.7 |

225.5 |

23 |

| 148 |

807 |

89.5 |

225.1 |

9 |

| 149 |

806 |

63.5 |

224.7 |

22 |

| 150 |

805 |

126.1 |

224.5 |

2 |

| 151 |

805 |

149.0 |

224.1 |

9 |

| 152 |

804 |

94.4 |

223.8 |

8 |

| 153 |

804 |

96.9 |

223.7 |

18 |

| 154 |

803 |

83.1 |

223.1 |

20 |

| 155 |

801 |

131.5 |

223.1 |

15 |

| 156 |

800 |

79.0 |

223.1 |

17 |

| 157 |

799 |

108.0 |

222.8 |

11 |

| 158 |

798 |

67.2 |

222.7 |

15 |

| 159 |

797 |

69.3 |

222.7 |

8 |

| 160 |

797 |

110.3 |

222.4 |

24 |

| 161 |

796 |

90.4 |

221.5 |

18 |

| 162 |

796 |

109.5 |

221.3 |

9 |

| 163 |

796 |

108.1 |

221.2 |

13 |

| 164 |

795 |

115.3 |

220.8 |

1 |

| 165 |

795 |

98.2 |

220.8 |

6 |

| 166 |

794 |

133.0 |

220.5 |

10 |

| 167 |

793 |

103.5 |

220.2 |

15 |

| 168 |

793 |

79.6 |

220.2 |

5 |

| 169 |

793 |

110.2 |

219.8 |

22 |

| 170 |

792 |

45.5 |

219.6 |

8 |

| 171 |

792 |

61.3 |

219.3 |

23 |

| 172 |

792 |

111.6 |

218.8 |

2 |

| 173 |

791 |

106.6 |

218.3 |

12 |

| 174 |

791 |

100.8 |

217.4 |

34 |

| 175 |

790 |

100.9 |

217.3 |

46 |

| 176 |

790 |

91.8 |

217.3 |

9 |

| 177 |

789 |

117.5 |

216.9 |

23 |

| 178 |

789 |

74.9 |

216.5 |

0 |

| 179 |

789 |

85.5 |

216.4 |

16 |

| 180 |

789 |

122.1 |

215.7 |

37 |

| 181 |

788 |

129.0 |

215.6 |

13 |

| 182 |

788 |

38.6 |

215.6 |

45 |

| 183 |

787 |

99.5 |

215.2 |

16 |

| 184 |

787 |

78.0 |

215.1 |

30 |

| 185 |

786 |

154.9 |

215.0 |

20 |

| 186 |

785 |

112.5 |

214.5 |

2 |

| 187 |

784 |

121.5 |

214.3 |

1 |

| 188 |

784 |

100.8 |

214.3 |

18 |

| 189 |

783 |

118.8 |

213.8 |

16 |

| 190 |

781 |

132.3 |

213.5 |

1 |

| 191 |

781 |

111.1 |

213.4 |

8 |

| 192 |

780 |

167.6 |

212.9 |

5 |

| 193 |

780 |

56.5 |

212.8 |

1 |

| 194 |

780 |

90.2 |

212.8 |

3 |

| 195 |

779 |

83.7 |

212.6 |

14 |

| 196 |

779 |

103.7 |

212.4 |

32 |

| 197 |

779 |

116.9 |

211.8 |

13 |

| 198 |

778 |

129.4 |

211.3 |

8 |

| 199 |

778 |

139.4 |

211.1 |

30 |

| 200 |

778 |

106.2 |

211.0 |

48 |

| 201 |

777 |

97.0 |

211.0 |

7 |

| 202 |

776 |

109.0 |

210.3 |

27 |

| 203 |

776 |

130.6 |

209.7 |

21 |

| 204 |

776 |

127.2 |

209.6 |

18 |

| 205 |

776 |

168.2 |

209.6 |

34 |

| 206 |

775 |

102.4 |

209.5 |

8 |

| 207 |

775 |

76.3 |

209.3 |

20 |

| 208 |

774 |

145.8 |

209.3 |

15 |

| 209 |

774 |

103.5 |

209.1 |

31 |

| 210 |

773 |

107.2 |

208.7 |

23 |

| 211 |

773 |

86.9 |

208.4 |

1 |

| 212 |

772 |

115.4 |

208.2 |

30 |

| 213 |

772 |

102.7 |

208.2 |

19 |

| 214 |

772 |

120.4 |

207.4 |

33 |

| 215 |

772 |

128.2 |

207.1 |

53 |

| 216 |

771 |

95.9 |

207.1 |

11 |

| 217 |

771 |

197.1 |

206.8 |

7 |

| 218 |

771 |

81.2 |

206.6 |

24 |

| 219 |

771 |

110.9 |

206.1 |

2 |

| 220 |

770 |

103.9 |

205.4 |

30 |

| 221 |

770 |

140.8 |

204.7 |

11 |

| 222 |

770 |

135.6 |

204.0 |

24 |

| 223 |

768 |

103.3 |

203.7 |

27 |

| 224 |

768 |

54.2 |

203.7 |

10 |

| 225 |

768 |

23.1 |

203.6 |

31 |

| 226 |

768 |

105.5 |

203.2 |

28 |

| 227 |

767 |

133.8 |

203.2 |

27 |

| 228 |

766 |

64.5 |

203.2 |

3 |

| 229 |

766 |

76.9 |

202.2 |

8 |

| 230 |

765 |

152.1 |

201.7 |

17 |

| 231 |

764 |

56.7 |

201.6 |

31 |

| 232 |

763 |

130.8 |

201.5 |

9 |

| 233 |

763 |

81.3 |

201.4 |

25 |

| 234 |

763 |

118.0 |

201.0 |

18 |

| 235 |

763 |

113.7 |

200.9 |

20 |

| 236 |

762 |

114.6 |

200.3 |

19 |

| 237 |

762 |

121.3 |

200.1 |

19 |

| 238 |

761 |

83.5 |

200.0 |

34 |

| 239 |

761 |

132.7 |

200.0 |

16 |

| 240 |

759 |

100.3 |

199.5 |

25 |

| 241 |

759 |

70.6 |

199.3 |

23 |

| 242 |

759 |

59.2 |

198.5 |

42 |

| 243 |

759 |

85.2 |

198.2 |

36 |

| 244 |

758 |

127.0 |

197.6 |

8 |

| 245 |

756 |

142.7 |

197.1 |

1 |

| 246 |

755 |

76.7 |

196.8 |

29 |

| 247 |

755 |

65.6 |

196.4 |

20 |

| 248 |

754 |

146.6 |

196.4 |

17 |

| 249 |

754 |

82.1 |

196.3 |

3 |

| 250 |

754 |

164.9 |

196.1 |

20 |

| 251 |

754 |

126.3 |

196.0 |

27 |

| 252 |

754 |

82.2 |

195.7 |

25 |

| 253 |

753 |

118.5 |

195.6 |

12 |

| 254 |

752 |

95.3 |

195.5 |

9 |

| 255 |

752 |

109.5 |

195.1 |

6 |

| 256 |

751 |

114.3 |

195.1 |

1 |

| 257 |

751 |

75.4 |

194.2 |

35 |

| 258 |

751 |

140.2 |

194.1 |

41 |

| 259 |

749 |

110.0 |

193.9 |

33 |

| 260 |

749 |

97.2 |

193.8 |

14 |

| 261 |

748 |

107.4 |

193.6 |

31 |

| 262 |

748 |

87.5 |

193.5 |

20 |

| 263 |

748 |

59.6 |

193.5 |

31 |

| 264 |

748 |

65.1 |

193.4 |

17 |

| 265 |

748 |

89.9 |

193.2 |

37 |

| 266 |

748 |

105.4 |

193.2 |

10 |

| 267 |

747 |

129.1 |

193.1 |

38 |

| 268 |

747 |

120.9 |

192.9 |

8 |

| 269 |

747 |

141.2 |

192.9 |

14 |

| 270 |

746 |

87.0 |

192.6 |

41 |

| 271 |

746 |

121.0 |

191.7 |

26 |

| 272 |

745 |

99.4 |

191.3 |

0 |

| 273 |

745 |

126.5 |

191.2 |

26 |

| 274 |

745 |

88.4 |

190.4 |

4 |

| 275 |

744 |

103.4 |

189.7 |

13 |

| 276 |

743 |

94.6 |

189.3 |

3 |

| 277 |

742 |

65.5 |

188.9 |

17 |

| 278 |

741 |

60.1 |

188.7 |

16 |

| 279 |

741 |

97.9 |

188.6 |

1 |

| 280 |

741 |

134.7 |

188.3 |

33 |

| 281 |

740 |

107.1 |

188.2 |

30 |

| 282 |

739 |

93.4 |

188.0 |

25 |

| 283 |

739 |

72.4 |

187.3 |

2 |

| 284 |

738 |

144.3 |

187.3 |

35 |

| 285 |

737 |

75.8 |

185.9 |

23 |

| 286 |

735 |

66.7 |

185.5 |

7 |

| 287 |

735 |

93.5 |

185.4 |

32 |

| 288 |

735 |

65.3 |

185.2 |

24 |

| 289 |

735 |

153.5 |

184.7 |

18 |

| 290 |

734 |

103.6 |

184.4 |

39 |

| 291 |

734 |

159.1 |

183.8 |

32 |

| 292 |

732 |

73.9 |

183.8 |

21 |

| 293 |

732 |

102.8 |

183.4 |

26 |

| 294 |

732 |

81.1 |

183.3 |

6 |

| 295 |

732 |

141.0 |

182.3 |

28 |

| 296 |

731 |

163.0 |

182.3 |

8 |

| 297 |

731 |

68.8 |

182.3 |

25 |

| 298 |

730 |

137.7 |

182.2 |

25 |

| 299 |

730 |

124.9 |

182.1 |

28 |

| 300 |

730 |

78.2 |

181.1 |

19 |

| 301 |

728 |

144.1 |

180.4 |

5 |

| 302 |

728 |

103.2 |

179.2 |

27 |

| 303 |

728 |

119.7 |

178.9 |

21 |

| 304 |

727 |

79.2 |

178.7 |

14 |

| 305 |

726 |

124.0 |

178.6 |

31 |

| 306 |

726 |

132.9 |

178.4 |

3 |

| 307 |

725 |

141.3 |

178.2 |

0 |

| 308 |

724 |

107.8 |

178.2 |

9 |

| 309 |

723 |

77.1 |

177.7 |

12 |

| 310 |

722 |

36.2 |

177.6 |

4 |

| 311 |

721 |

19.8 |

177.5 |

17 |

| 312 |

720 |

186.3 |

177.3 |

12 |

| 313 |

720 |

137.6 |

177.1 |

11 |

| 314 |

719 |

149.2 |

176.3 |

30 |

| 315 |

717 |

134.5 |

176.3 |

20 |

| 316 |

717 |

24.8 |

175.2 |

29 |

| 317 |

717 |

114.7 |

174.9 |

26 |

| 318 |

716 |

64.3 |

174.8 |

18 |

| 319 |

714 |

65.4 |

174.7 |

10 |

| 320 |

714 |

167.5 |

174.4 |

35 |

| 321 |

712 |

106.8 |

174.2 |

17 |

| 322 |

712 |

123.7 |

174.0 |

37 |

| 323 |

712 |

67.0 |

173.8 |

11 |

| 324 |

710 |

108.2 |

173.2 |

26 |

| 325 |

710 |

118.8 |

172.9 |

25 |

| 326 |

710 |

108.4 |

172.8 |

29 |

| 327 |

708 |

123.9 |

172.7 |

31 |

| 328 |

707 |

85.6 |

172.6 |

40 |

| 329 |

704 |

154.7 |

172.0 |

7 |

| 330 |

704 |

118.8 |

169.6 |

11 |

| 331 |

702 |

108.2 |

168.9 |

16 |

| 332 |

702 |

91.1 |

167.7 |

12 |

| 333 |

702 |

96.0 |

166.9 |

15 |

| 334 |

700 |

50.3 |

165.3 |

6 |

| 335 |

699 |

107.4 |

164.8 |

21 |

| 336 |

698 |

105.5 |

164.7 |

26 |

| 337 |

697 |

108.2 |

164.7 |

13 |

| 338 |

696 |

132.7 |

164.6 |

34 |

| 339 |

694 |

138.2 |

164.0 |

7 |

| 340 |

691 |

113.1 |

164.0 |

27 |

| 341 |

691 |

130.2 |

163.2 |

4 |

| 342 |

691 |

63.1 |

163.0 |

12 |

| 343 |

690 |

63.6 |

162.6 |

0 |

| 344 |

689 |

73.6 |

162.3 |

24 |

| 345 |

689 |

135.2 |

160.6 |

20 |

| 346 |

688 |

85.9 |

160.4 |

26 |

| 347 |

688 |

101.2 |

159.9 |

0 |

| 348 |

687 |

63.7 |

159.8 |

2 |

| 349 |

686 |

97.2 |

159.4 |

9 |

| 350 |

684 |

119.4 |

159.2 |

13 |

| 351 |

683 |

140.2 |

158.7 |

1 |

| 352 |

682 |

164.7 |

156.0 |

17 |

| 353 |

681 |

148.3 |

155.9 |

46 |

| 354 |

681 |

84.0 |

155.8 |

12 |

| 355 |

680 |

111.1 |

155.3 |

14 |

| 356 |

678 |

81.8 |

154.4 |

54 |

| 357 |

677 |

122.9 |

154.2 |

8 |

| 358 |

673 |

98.4 |

153.7 |

22 |

| 359 |

673 |

115.1 |

152.8 |

34 |

| 360 |

669 |

87.4 |

152.3 |

27 |

| 361 |

667 |

135.0 |

152.0 |

33 |

| 362 |

667 |

120.4 |

150.6 |

21 |

| 363 |

662 |

87.9 |

149.8 |

5 |

| 364 |

661 |

100.4 |

149.7 |

19 |

| 365 |

660 |

107.4 |

147.4 |

17 |

| 366 |

659 |

103.4 |

144.9 |

20 |

| 367 |

659 |

141.8 |

143.6 |

30 |

| 368 |

658 |

120.9 |

143.3 |

33 |

| 369 |

655 |

70.6 |

143.0 |

18 |

| 370 |

654 |

119.0 |

142.7 |

13 |

| 371 |

654 |

63.5 |

141.3 |

30 |

| 372 |

652 |

120.9 |

140.7 |

13 |

| 373 |

651 |

140.1 |

140.7 |

7 |

| 374 |

648 |

138.3 |

139.6 |

34 |

| 375 |

647 |

133.7 |

137.6 |

33 |

| 376 |

647 |

101.3 |

137.4 |

8 |

| 377 |

647 |

134.1 |

133.7 |

20 |

| 378 |

645 |

118.2 |

130.7 |

10 |

| 379 |

644 |

103.6 |

130.3 |

19 |

| 380 |

642 |

67.9 |

129.1 |

22 |

| 381 |

638 |

113.1 |

125.5 |

1 |

| 382 |

637 |

144.8 |

124.2 |

30 |

| 383 |

636 |

93.8 |

123.1 |

21 |

| 384 |

635 |

165.5 |

122.6 |

12 |

| 385 |

630 |

154.3 |

122.2 |

18 |

| 386 |

625 |

123.0 |

119.4 |

21 |

| 387 |

625 |

81.2 |

118.3 |

0 |

| 388 |

621 |

88.1 |

117.9 |

9 |

| 389 |

615 |

86.6 |

117.8 |

31 |

| 390 |

613 |

25.7 |

111.0 |

0 |

| 391 |

611 |

107.3 |

110.8 |

7 |

| 392 |

607 |

86.8 |

110.6 |

4 |

| 393 |

606 |

76.3 |

109.4 |

6 |

| 394 |

601 |

135.0 |

109.1 |

6 |

| 395 |

599 |

81.8 |

106.7 |

15 |

| 396 |

597 |

48.0 |

104.9 |

11 |

| 397 |

594 |

123.1 |

103.3 |

25 |

| 398 |

574 |

92.6 |

103.2 |

28 |

| 399 |

549 |

103.0 |

101.1 |

21 |

| 400 |

541 |

72.5 |

84.7 |

31 |

| Sale Price |

|

|

| Land size |

Land size in Square meters

|

|

| Year Built |

|

|

Introduction

Accounting standards are the policies and the procedure that is developed by the Australian accounting standard board that helps in developing the rules and regulation in the company. The rules are applicable to the private as well as the public sectors of the company that are working and incorporated in Australia. Every company that has been working in Australia and listed or not listed on the Australian stock exchange has to follow the accounting standards that are developed in the sector and those which are applicable to the company. The standards help in building a good image and reputation of the company in front of other competitor companies. The company that is following the rules and regulations that are developed by the board helps in understanding the policies of the company. The investors also have trust in that company which is properly complying the rules and regulations.

Descriptions of Accounting Concepts

Accounting concepts refer to the rules and the regulations that are used for the purpose of recording and explanation of the transaction in the financial statements of the company. These are the use and incorporated in the public and the private sector companies and all the other amount of independent entities that are working in the Australian sector market. Accounting concepts help the investors and the other stakeholders to develop an opinion towards the company towards the process of governance. Accounting concepts help professionals to develop an understanding of the different concepts that are used in the business. It amounts to develop a good amount of knowledge in the company and the market area (Holland, 2016). The standards that are used by the BHP Billiton Limited to increase the reputation in the developed Australian market are as follows

- The company has maintained the standards that are for the presentation of the financial statements of the company in the proper format that is provided by the Australian board. The accounting standards developed for this purpose are the AASB 101 that helps to give the structure and content of the financial statements.

- The second concept that is used by the company is the AASB 102 that is for the purpose of the accounting of the inventories. It amounts to develop the cost of the inventories and also amount to determine the revenue of the company. It also helps in determining the net realizable value for the company. It defines the accounting treatment of inventories that are in the use of the company.

- The company also follows the standards AASB 1031 in respect of the materiality of the transaction developed in the company. The materiality depends on the size and the nature of the business that is carried out by the company. It helps in developing and making judgments regarding the decision and the presentation of the financial statements (Joubert, et. Al., 2017).

- The company also develops the standards AASB 1054 for the purpose of the additional disclosure in the company. The additional disclosure includes the report of the auditor and the other nature of the service that is undertaken by the company in development of the various activities.

- The company also follows the principles of AASB 1039 to develop the annual reporting that is consolidated for the subsidiaries of the BHP Billiton Limited. The preparation and the presentation also amount to develop various amount of disclosures in the company.

- The revenue recognition concepts are also used by the company to measure the fair value of the revenue or the amount of consideration that is received by the company. Revenue also helps in developing the risk and the rewards of the company that is to be based on the method of the delivery.

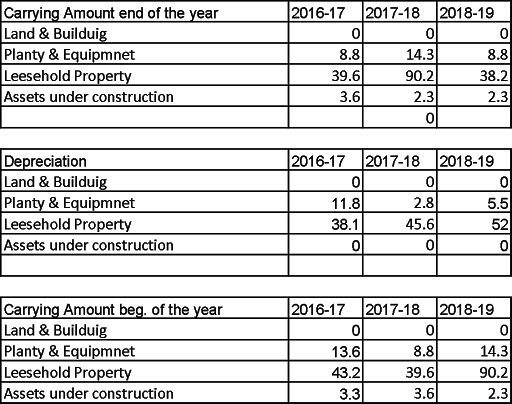

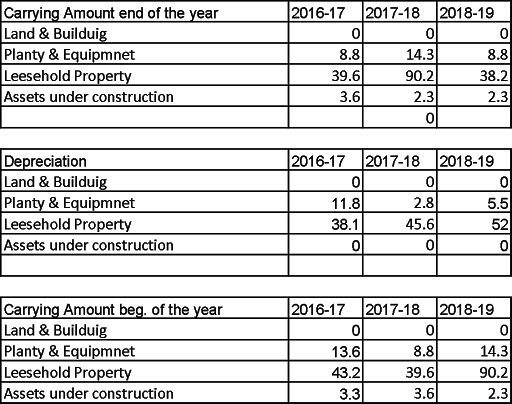

- The company also uses the concept of depreciation to calculate the amount of depreciation that is levied on the assets developed in the company. The amortization and the useful life of the asset also amount to calculate on this basis (Dakis, 2016).

Why changes have been incorporated in the new accounting standard for lease AASB 16?

The various changes have been incorporated in the accounting standard that is developed by the Australian board. The changes that are developed the new model of the lease in the different amount of companies on the balance sheet. It does not recognize the short-term lease and the lease on the low value of the assets developed by the company. The changes are developed and issued by the Australian board in February 2016 but it came in the action in the year 2019. This lease has developed a lot amount of changes in the Australian companies that are listed on the Australian stock exchange. The companies that are mostly affected by the changes in the lease concepts are the mining, aircraft and the other various industries of the company. The new standards have to be used by the company with the proper amount and knowledge and the guidance that is developed by the company. The standard helps in developing one or more accounting changes in the company and the companies also need to develop the various other implications before implementing this system in the organization. The company adapts this leasing system because it helps in increasing the lease liability of the company and helps to develop the various issues in the company in regards to the profitability (Chan & Ryan, 2013).

Real estate sector may be in the possession of the various different amount of the lease and the change in the accounting standard also impact the development that is relating to the change. Some points are very much stronger than it helps in developing the company with the various issues that are going to develop the company soon but some points are not classified under the lease. The various amount of lease effect the significant entities of the company and also the recognition will not be easy and effective. The recognition and the development of the new lease system that is developed by the board affect the performance indicators of the company in a negative way. The cash flow and the earnings of the company are mostly affected by the lease that is developed newly in the organisation. The principal and the amount of interest developed by the company will also amount to be affected by the new standards developed in place of the lease. The new development in the accounting system helps in revising the lease and minimize the impacts of the assets and the liabilities of the company (Brumm & Liu, 2019).

The new development in the standards gives the option to the company to measure the assets in respect of the liability developed in the company whereas in AASB 16 the asset should be measured in terms of the lease commencement of the company. The outstanding liability amounts to be considered by the company using the different rates of the borrowing that is developed by the company at the date of the transition. In the AASB 16 we have to develop the new project and other amounts of implementation for the company. The development of the new standards helps in early planning and preparation of the project for the company and the other amount of developments in the company. To avoid the consequences the contractual agreements need to be made in the development of the company and the other amount of methods in developing the company. These new standards also help in the tax relief developed by the company and maintaining the lease account separately by the company with the help of the developed standard (AASB, 2016).

Both the option either it is the old one or the new one it helps in reducing the net assets of the company and also helps in developing the borrowing rate of the company. The new lase developed by the Australian board does not affect the net asset of the company but it helps in reducing the profit of the company. This also helps the company give to receive a large amount of tax relief from the other situations of the company. The standards help in providing the relevant information that is developed in the manner of the lease and for the lease transactions of the company. The total expense developed after using the new standard that is developed for the purpose of the lease as compared to the other amount or the amount that is developed with the using of the old standard. It also impacts the financial position of the company that is the net assets and the other amount of assets and liabilities that amount to develop in the company. It may result in significant savings and the development and growth in the company in regard to the various other liabilities (Lease, 2019).

Summarise the key disclosure the company has made on its accounting for leases including on the transitional provision and effect of the transition to AASB 16 from AASB 117.

Asset under the lease results in developing the risk and rewards of the company and also the amount to capitalize the assets of the BHP Company. The lease assets of the company are treated same as that of the other assets of the company. The depreciation levying on the assets also amounts to be same and developed the accounting treatment on that basis only. The disclosure made by the company on the basis of the lease are as follows

- The financial lease of the company is included in the interest liability of the company that is showed in the balance sheet of the company under this heading and developed the calculation on that amount.

- The interest also amounts to show the constant rate of interest over the remaining period of the time when the company is amount to bear the lease amount on the interest of the company.

- The operating lease of the BHP Company are not capitalized and they are not treated as the capital expenditure of the company and also amount to include in the profit and loss statement of the company and also in the cash flow statement of the company (Potter, et. Al., 2013).

- The rental payments that are included in the lease amount to be charged on the straight-line basis it means same in every year. The other lease also amounts to be disclosed by the company but in the separate headings.

- Ongoing commitments are also disclosed by the BHP Company in the commitments that are developed by the company in the balance sheet of the company and also developed in the other amount by the company.

These are some of the disclosures that are made by the company in which the company undertakes the new amount of lease in the process of developing the lease in the financial statements of the company. Every lease of the company is different but the new standard that is developed on the lease will affect the most by the mining companies that are the BHP Company of Australia. The various amount of transitional relief is developed by the company on behalf of the lease that is particularly for the amount of lease that is developed in the company (Stevenson, 2012). Both the lessee and the lessor are available for the purpose of the exemption that is granted by the authorities only if they amount to develop the new standards that are developed by the board in Australia in relation to the accounting standards of the company.

There is number of effects that are developed by the company using this system. The BHP Company has discovered that the company is suffering the loss in the various key performance indicators of the company. The company should also develop an effect on the tax amount. The tax amount gets decreased due to the change in the assets and the liabilities of the company that is developed for the purpose of this account of transaction of the company. The company should also receive the impact on the dividends that are developed by the company using the various amount of negativity developed in the company. To avoid the various consequences that are developed in the company using the new standards the company has given the transitional period to change this accounting from the other amount of accounting developed by the company (Xu, et. Al., 2017).

The changes in the standards also have the positive and the negative impacts on the company and they amount to provide relief to the company. The changes help in ensuring that there is two amount of option that is available to the company that helps in reducing the tax for the company and develops the company in a positive way.

Conclusion

From the above analysis, it is clear that the BHP Company is following all amount of rules and regulations and that why it is ranked as number second among all the industries working in Australia. The accounting concepts also affect the decision of the investors of the company and there is also the difference between the actual and the estimated results of the company. The disclosure of the accounting standard of lease helps the company in giving the clarity of decisions by the company and also amount to develop the trust in the company. Disclosure helps the lease properties to develop themselves and also have the tax deduction of the impairment of the assets. Changes that are made in the provisions of lease help in reducing the burden of the company on the disclosure of the information and the other amount of things.

References

AASB, C.A.S., 2016. Consolidated Financial Statements.

Annual report (2019). Welcome to BHP Billiton Limited. [Online]. Annual report. Available at: https://www.bhp.com/-/media/documents/investors/annual-reports/2018/bhpannualreport2018.pdf. [Accessed at: 30 September 2019]

Brumm, L. and Liu, J., 2019. New leasing accounting standard. Taxation in Australia, 53(8), p.449.

Chan, H.T. and Ryan, S., 2013. Challenging stereotypes: International accounting students in Australia. Journal of Modern Accounting and Auditing, 9(2), p.169.

Dakis, G.S., 2016. Upcoming changes to contributions and leasing standards. Governance Directions, 68(2), p.99.

Holland, D., 2016. Simplifying income recognition for not-for-profit entities. Governance Directions, 68(11), p.666.

Joubert, M., Garvie, L. and Parle, G., 2017. Implications of the New Accounting Standard for Leases AASB 16 (IFRS 16) with the Inclusion of Operating Leases in the Balance Sheet. The Journal of New Business Ideas & Trends, 15(2), pp.1-11.

Lease (2019). A guide to AASB 16. [Online]. Lease. Available at: https://www2.deloitte.com/content/dam/Deloitte/au/Documents/audit/deloitte-au-audit-aasb-16-guide-220916.pdf. [Accessed at: 30 September 2019]

Marşap, B. and Yanık, S., 2018. IFRS 16 Kapsamında Kiralama İşlemlerinin Finansal Raporlamaya Etkisinin İncelenmesi. Muhasebe ve Finansman Dergisi, (80).

Potter, B., Ravlic, T. and Wright, S., 2013. Developing accounting regulations that reflect public viewpoints: the Australian solution to differential reporting. Australian Accounting Review, 23(1), pp.18-28.

Stevenson, K.M., 2012. The changing IASB and AASB relationship. Australian Accounting Review, 22(3), pp.239-243.

Xu, W., Davidson, R.A. and Cheong, C.S., 2017. Converting financial statements: operating to capitalised leases. Pacific accounting review, 29(1), pp.34-54.

Abstract

The assignment is to make on the research and analysis of the financial performance of the selected company as we selected the Medibank private limited so we are going to analyse the medibank financial performance. This assignment requires making a comprehensive and detailed examination of the financial statement and its annual report, its share market, its market value, to come out the conclusion regarding the financial position and strength of the company. The financial statement gives overall data of the company of the same year. Analysis of financial performance can be done by making a comparison for two year or previous year’s data, these financial data helps to identify the real situation of the company. Financial strength can be measured by making the market analysis of customer satisfaction by its products and services offered by the company. This analysis report is required to make to provide advice to the wealthy investors regarding the financial position, its stability in the market, its transparency in the market. This analytical report gives assurance and a kind of satisfaction before making the investment in it. So that members trust can be enhanced by making believe on the productivity of the company.

I Introduction

Organisation that is selected for analysis in this report is Medibank Pvt. Limited. Medibank commenced on 1 July 1975 after passing the medibank legislation by joint sitting of parliament on 7 august 1974.the health insurance bill 1973 was the main bill that established MEDIBANK. Medibank private limited is a national private health insurer based company in Australia. It is second largest health insurance provider of Australia with the 3.8 million members & 29.1% market under two brands (medibank and ahm) .this company was set up to provide competition to private “ profit making company” health funds. Medibank was previously run as a not for profit organisation and later operated as a for profit government business enterprises with dividends paid to the federal government. It is a listed company on ASX. Medibank invests in community programs that support the health of all Australian this includes growing healthy kids which encourage healthy and active lifestyle in childhood.

II Financial Analysis of selected company

Description of one key product or service provided by the company

PRODUCTS OF THE COMPANY: COMPANY is providing the following services:

- Private health insurance

- Travel insurance

- Life insurance

- Pet insurance

- Workplace health promotion

- Workplace health management

- Health call centre.

Out the above one key product or services offered by the company are:

Private health insurance: private health insurance is also main product or services which are offered by medibank private limited (Medibank.com, 2019).

Health insurance policy is very important for managing the health issues, health care needs and health related expenses (Mustafa, et. al., 2012). We can claim the tax benefits under section 80D of the IT Act.

There are multiple health policy are available in the market which makes us confused , out of these which is best for us..

WHY MEDIBANK HEALTH INSURANCE

Medibank private limited health insurance policy is better than others.